Sterling Technical Price Outlook: GBP/USD Weekly Trade Levels

- Sterling technical trade level update – Weekly Chart

- GBP/USD Breakout reverses sharply off uptrend resistance / multi-year highs

- Key resistance into the 1.43-handle – Support 1.3743, constructive while above 1.3675

The British Pound snapped a six-week winning streak last week with Sterling reversing sharply off technical uptrend resistance. The threat of a deeper correction within the broader uptrend looms while below the 1.40-handle. These are the updated targets and invalidation levels that matter on the GBP/USD weekly technical chart. Review my latest Strategy Webinar for an in-depth breakdown of this Cable trade setup and more.

Sterling Price Chart - GBP/USD Weekly

Chart Prepared by Michael Boutros, Technical Strategist; GBP/USD on Tradingview

Notes: In last month’s Sterling Weekly Price Outlook we noted that a GBP/USD breakout was underway and to be on the lookout for, “downside exhaustion ahead of 1.3675 on pullbacks IF price is indeed heading higher with initial resistance objectives eyed above the 1.39-handle.” Pullbacks were limited to 1.3776 in the following days before surging higher with Cable rallying into confluence resistance at multi-year highs into the close of February at 1.4236-1.4303 – a region defined by the 2018 high-close & the 50% retracement of the 2014 decline and converges on basic channel resistance. Is a high in place?

Initial weekly support now rests at the former 2020 trendline resistance (currently ~1.38) backed closely the 78.6% Fibonacci retracement at 1.3743 and 1.3675. Broader bullish invalidation now raised to the 2017 high-week reversal close at 1.3494. Initial resistance stands with the 2018 high week-close at 1.3997 with a breach above the 2018 stretch high at 1.4377 needed to mark resumption of the broader Sterling uptrend.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

Bottom Line: The Sterling breakout may be vulnerable in the weeks ahead after reversing sharply off technical uptrend resistance. From at trading standpoint, the risk remains for a deeper pullback while below the 1.40-handle. Ultimately, a larger pullback may offer more favorable entries closer to uptrend support with a topside breach above this key resistance zone needed to fuel the next leg higher in the British Pound. I’ll publish an updated Sterling Price Outlook once we get further clarity on the near-term GBP/USD technical trade levels.

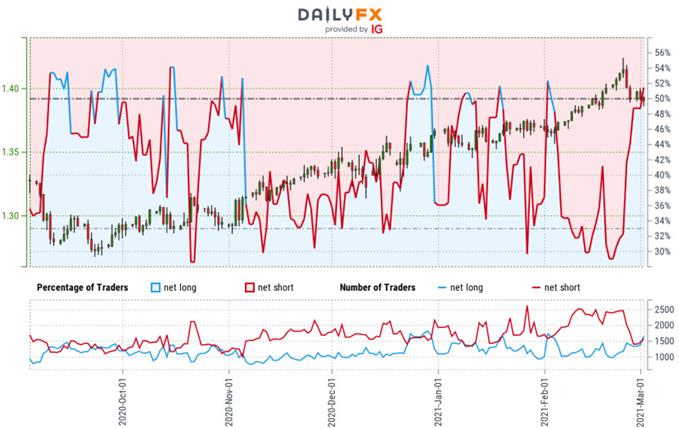

Sterling Trader Sentiment - GBP/USD Price Chart

- A summary of IG Client Sentiment shows traders are net-short GBP/USD - the ratio stands at –1.03 (49.36% of traders are long) – neutral reading

- Long positions are1.08% lower than yesterday and 29.40% higher from last week

- Short positions are4.91% higher than yesterday and 32.74% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/USD prices may continue to rise. Yet traders are more net-short than yesterday but less net-short from last week and the combination of current positioning and recent changes gives us a further mixed GBP/USD trading bias sentiment standpoint.

| Change in | Longs | Shorts | OI |

| Daily | -5% | -1% | -3% |

| Weekly | -5% | 15% | 1% |

---

Key UK / US Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Previous Weekly Technical Charts

- Canadian Dollar (USD/CAD)

- Gold (XAU/USD)

- Australian Dollar (AUD/USD)

- Crude Oil (WTI)

- Euro (EUR/USD)

- US Dollar (DXY)

- Japanese Yen (USD/JPY)

--- Written by Michael Boutros, Technical Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex