GBP/USD Highlights:

- GBP/USD grinding its way higher towards a big level

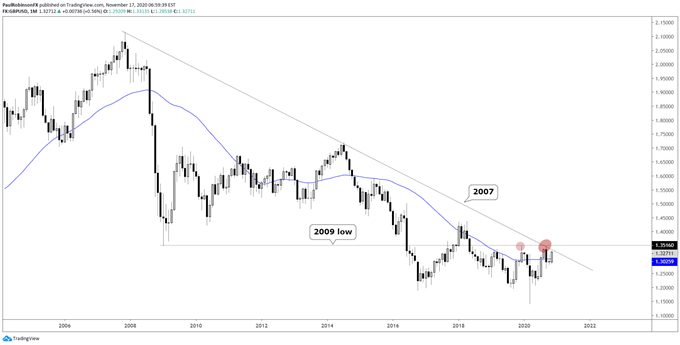

- 13500 has confluent resistance dating back many years

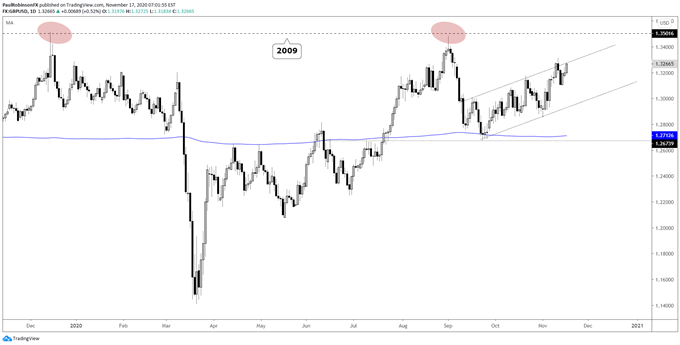

GBP/USD has been on a bit of a ‘jagged-tooth’ run, with momentum stalling just about the time it looks like it is ready to accelerate. Perhaps we see cable turn down here again soon before trying to resume higher, or just simply roll over, but if it can keep making its way higher a big test lies ahead.

The 13500-area is a big one, with long-term levels/lines in confluence. Two very important turning points are included, with the 2007 top having a trend-line project lower off of it over 2014/2020 highs, and the 2009 low having become influential a couple of times in the past year.

The most recent turn down from confluence was at the end of August, where the lines were in almost exact alignment. Since then the trend-line has further descended, putting it a little under 13500. But let’s not split hairs, we are talking about levels from over a decade ago, so a little latitude is needed.

Another test could bring some longer-term clarity, perhaps. Finding big-picture clarity in this market has been hard to do, with major FX pairs broadly rangebound for the better part of the last five years. A firm weekly close above 13500 could open up a path of much higher levels.

A rejection from resistance will bring less clarity as it continues to keep price contained. If the rejection were hard enough it may indicate that a sizable decline back towards the 2020 lows wants to develop, but will be a less compelling case than if we see a breakout.

For now, in wait-and-see mode. Maybe we will see an end-of-year move that surprises as the stage gets set for 2021.

GBP/USD Monthly Chart (big intersection at ~13500)

GBP/USD Daily Chart (grinding towards test)

Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX