GBP/USD Analysis:

- UK-EU negotiations hit stumbling block over state aid rules, reigniting no deal Brexit possibility

- GBP/USD has advanced higher despite invalidated bullish pennant formation with minor pullback developing

- IG Client Sentiment hints at possible trend continuation. 71.3 % of IG clients remain short

UK Prime Minister, Boris Johnson Standing Firm on Subsidy Issue

The UK and EU chief Brexit negotiators have hit what seems like an impasse over the UK’s subsidy regime that will be published at the end of September. The EU wishes for the UK to continue following rules that prevent the UK Government from subsidizing British companies at the expense of European competitors. This represents another challenge in getting a deal across the line before the end of the year.

Sterling Digests Recent High as Minor Pullback Takes Shape

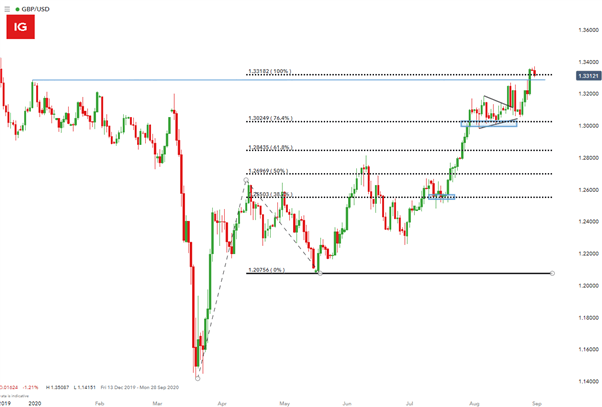

Cable is cooling off slightly after posting a fresh yearly high on Friday. The pair faces considerable near-term support at both the 100% Fibonacci extension of the March-April major move and the December 31st high (2019) in blue.

GBP/USD Daily Chart

Chart prepared by Richard Snow, IG

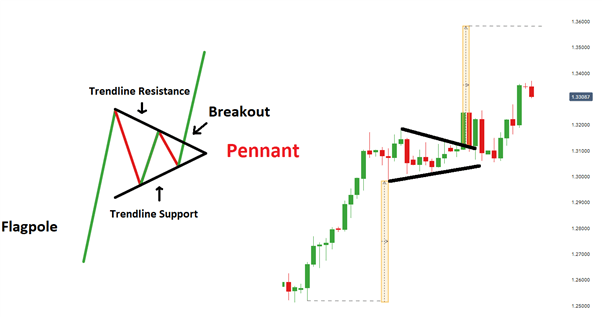

The pair advanced higher despite a failed bullish pennant formation in late August as the dollar weakened substantially against its peers.

Cable Advanced Higher Despite Failed Bullish Pennant Formation

Read our article on the Bullish Pennant formation for more insight on how to identify and apply this pattern to price charts

GBP/USD Technical Levels

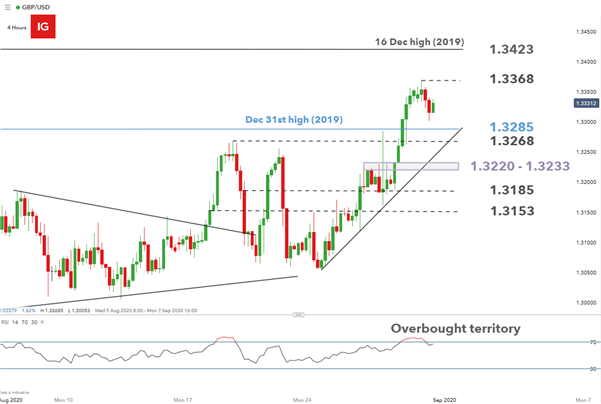

Looking at the 4-hour chart, Cable moved lower off the recent high. A continued move lower would see it test the December 31st 2019 high before testing the 1.3268 level. Should bears take hold at this point there may be a larger move down towards the zone of support between 1.3220 and 1.3233 and possibly even 1.3153.

GBP/USD bulls may be on the look-out for a pullback towards the short term trendline support. Should the market move higher, the yearly high of 1.3368 becomes the nearest level of resistance before the 16 December 2019 high comes into focus at 1.3423.

GBP/USD 4-Hour Chart with Technical Levels

Chart prepared by Richard Snow, IG

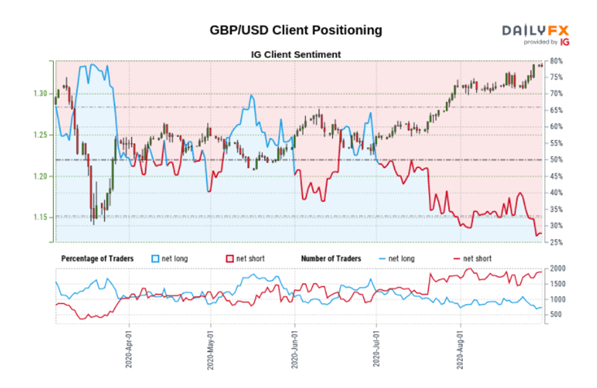

IG Sentiment Data Hints at Potential Trend Continuation

- GBP/USD retail trader data shows 28.69% of traders are net-long with the ratio of traders short to long at 2.49 to 1

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/USD prices may continue to rise.

See our advanced guide on How to use IG Client Sentiment when Trading

- The number of traders net-long is 14.20% higher than yesterday and 27.99% lower from last week, while the number of traders net-short is 3.67% higher than yesterday and 28.62% higher from last week.

- The combination of current sentiment and recent changes gives us a further mixed GBP/USD trading bias.

--- Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX