GBP/USD TECHNICAL ANALYSIS – TALKING POINTS:

- British Pound rejected downward after retesting former support level

- Chart setup hints long-term decline resuming after 4-month recovery

- Retail trader sentiment studies bolster the case for a bearish scenario

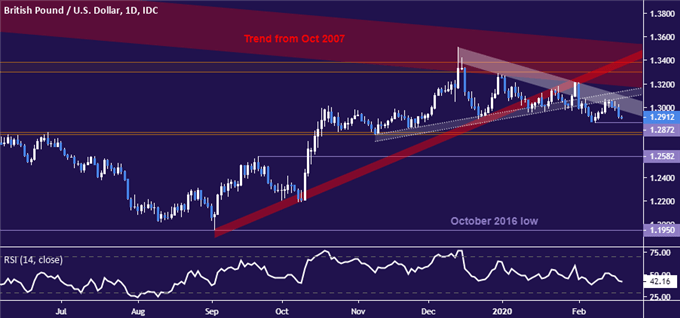

The British Pound recoiled from support-turned-resistance set from early November, dropping back toward its monthly low against the US Dollarat 1.2872. A break below that confirmed on a daily closing basis opens the door for a test of the 1.2763-84 inflection area.

The decline keeps alive the downtrend in play since mid-December 2019 and sustains the bearish implications of a mid-January break through four-month rising trend support. That breach suggested that a corrective recovery had run its course, setting the stage for resumption of the long-term decline from 2007 peaks.

GBP/USD daily chart created with TradingView

A daily close above falling trend resistance from December’s spike high – now squarely at the 1.31 figure – is probably a prerequisite for neutralizing near-term selling pressure. That would probably clear the way for another challenge of multi-year resistance. Its outer layer is now at 1.3555.

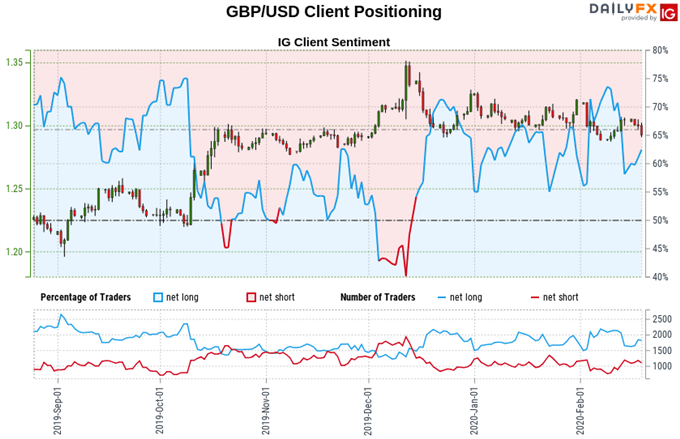

GBP/USD TRADER SENTIMENT

Retail trader data shows 69.04% of traders are net-long, with the long-to-short ratio at 2.23 to 1. The number of traders net-long is 7.63% higher than yesterday and 4.26% lower compared with last week.The number of traders net-short is 20.11% lower than yesterday and 15.54% lower from one week prior.

IG Client Sentiment (IGCS) is typically used as a contrarian indicator, traders being net-long suggests GBP/USD may continue to fall.Traders are further net-long than yesterday and last week, which implies a stronger GBP/USD-bearish sentiment trading bias.

See the full IGCS sentiment report here.

GBP/USD TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free webinar and have your questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter