GBP/USD: Cable Continues to Coil as Brexit Suspense Builds

GBP/USD Talking Points:

- Brexit dynamics continue to push prices in the British Pound in both directions with the net of last week being a loss of 141 pips. Within this range, however, was considerable volatility as last week’s gap-lower was faded-out on news that Brexit negotiators had come to a draft of a deal. Gains entirely slipped away on Thursday morning, however, on news that Brexit minister, Dominic Raab, was going to resign his post.

- Despite last week’s events, there still remains a brutal lack of clarity around Brexit. The deal draft appears to have considerable opposition and it doesn’t seem as though British PM Theresa May will be able to push it through Parliament. This leaves even more questions around the matter, and tomorrow morning will see BoE Governor, Mark Carney, taking questions from the Treasury Select Committee.

- DailyFX Forecasts on a variety of currencies such as the US Dollar or the Euro are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.

Do you want to see how retail traders are currently trading the US Dollar? Check out our IG Client Sentiment Indicator.

It’s been a dizzying week of price action for short-term traders in GBP/USD, and as the backdrop around Brexit continues to grow even more-opaque, that appears set to continue. A number of questions remain on the Brexit-front as last week’s draft of a deal led to a number of high-scale resignations from Theresa May’s cabinet. At this point, gaining Parliamentary approval looks to be unlikely and this can keep certainty at bay as a deal that appears very unpopular within the UK is pitched as the only way to avoid a no-deal scenario.

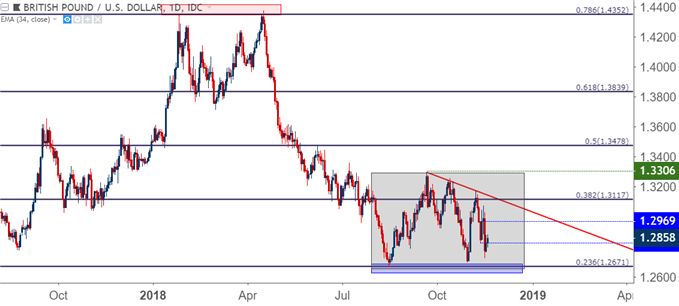

For its part, the British Pound has been surprisingly stable on a longer-term basis, continuing to trade within the range of the past few months with support at 1.2671 and resistance around the 1.3300-handle.

GBP/USD Daily Price Chart

Chart prepared by James Stanley

On a shorter-term basis, however, matters on the chart are a bit more chaotic: Last week saw GBP/USD gap-down and continue to run-lower until news that a draft had been agreed upon. That helped GBP/USD to recover above the 1.3000 handle, although that turned out to be a temporary move as prices scaled right back-down as the contents of that draft leaked. The big bearish factor from last week appeared to come into play around the resignation of Brexit minister, Dominic Raab. This took place on Thursday morning and sent GBP/USD spiraling-lower. Bears calmed ahead of a 1.2700 re-test, and a pullback from that move has continued into a fresh week with GBP/USD making a run at the 1.2900-handle.

GBP/USD Two-Hour Price Chart

Chart prepared by James Stanley

Carney Testimony On Deck

As if Brexit wasn’t a large enough issue to contend with for GBP/USD traders, tomorrow morning’s economic calendar brings another factor of importance when BoE Governor, Mark Carney, testifies before the UK Treasury Select Committee. Brexit will be a key topic of discussion, and further commentary from Mr. Carney may help to bring a bullish factor to the currency as the most recent comments from head of the bank appeared to be supportive of continued policy tightening. At the BoE’s ‘Super Thursday’ rate decision earlier in the month, the bank hastened forecasts for hikes while also saying that “the economic outlook will depend significantly on the nature of EU withdrawal.”

The net response to that rate decision was a strong showing in the British Pound, as GBP/USD put in its strongest single day of performance since April of 2017.

GBP/USD Moving Forward

This can be a difficult time to work with a difficult market, as this week will usher in holiday-conditions as the US celebrates Thanksgiving on Thursday with Black Friday to follow. This will normally bring on low liquidity in financial markets and this can make for a dangerous backdrop around the British Pound, as low liquidity matched with big drivers can create sharp moves that are even more unpredictable than normal.

On a bigger picture basis, traders will still likely want to await some element of resolution of the three-month range before looking to implement directional strategies. The support side of that area is nearby but, up to this stage, sellers have continued to shy away from a re-test of the 1.2671. This is the 23.6% Fibonacci retracement of the ‘Brexit move’ in the pair, taking the June, 2016 high down to the October, 2016 low. Since that level came into play to mark the yearly low in mid-August, bears have shied away from a re-test on two separate occasions; in late-October and again last week.

GBP/USD Weekly Price Chart

Chart prepared by James Stanley

To read more:

Are you looking for longer-term analysis on the U.S. Dollar? Our DailyFX Forecasts for Q4 have a section for each major currency, and we also offer a plethora of resources on USD-pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our IG Client Sentiment Indicator.

Forex Trading Resources

DailyFX offers a plethora of tools, indicators and resources to help traders. For those looking for trading ideas, our IG Client Sentiment shows the positioning of retail traders with actual live trades and positions. Our trading guides bring our DailyFX Quarterly Forecasts and our Top Trading Opportunities; and our real-time news feed has intra-day interactions from the DailyFX team. And if you’re looking for real-time analysis, our DailyFX Webinars offer numerous sessions each week in which you can see how and why we’re looking at what we’re looking at.

If you’re looking for educational information, our New to FX guide is there to help new(er) traders while our Traits of Successful Traders research is built to help sharpen the skill set by focusing on risk and trade management.

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX