To receive James Stanley’s Analysis directly via email, please sign up here.

Talking Points:

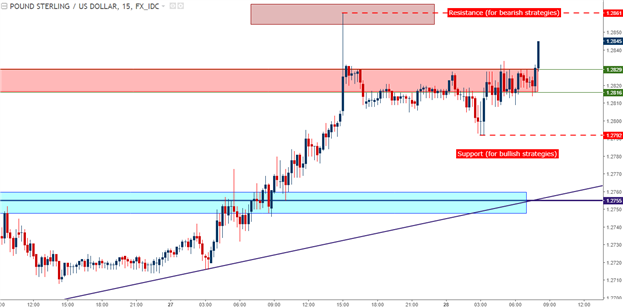

- GBP/USD Technical Strategy: Bearish longer-term trend with near-term bullish reversal.

- GBP/USD has put in a bullish reversal as the Dollar has run down to fresh seven-month lows.

- If you’re looking for trading ideas, check out our Trading Guides. They’re free and updated for Q1, 2017. If you’re looking for ideas more short-term in nature, please check out our IG Client Sentiment.

Over the past week, the British Pound has put in the makings of what looks to be a bullish move on shorter-term charts. After falling to a fresh near-term low of 1.2587 last week, USD-weakness has taken over and Cable has popped-higher, setting a new post-Election high in the process. On the hourly chart below, we’re looking at this bullish move building over the past week after that low was set last Wednesday.

GBP/USD up to Fresh post-Election Highs

Chart prepared by James Stanley

Going along with this move has been a pronounced sell-off in the U.S. Dollar as DXY has sunk to fresh seven-month lows. This has driven many currency pairs up to fresh highs, such as EUR/USD setting a new one-year high water-mark. GBP/USD continues to recover from the post-Election sell-off that took place earlier in June, and with this rally over the past two days, the pair is now trading at fresh post-Election highs.

Chart prepared by James Stanley

In yesterday’s Market Talk article, we looked at a zone of what we had called ‘secondary resistance’ from the levels of 1.2813-1.2830. Each of those levels come from prior price action swing-highs, and this has produced a zone that appears to have caught some near-term resistance. In the midst of yesterday’s Dollar sell-off, we did see some penetration of this zone, albeit briefly, before sellers came-in to offer Cable-lower.

For traders looking at bullish exposure in Cable, under the anticipation that this rout in the U.S. Dollar might continue, they’d likely want to keep risk relatively tight, looking to the daily low of 1.2791 for stop placement on topside strategies. For those looking at bearish reversal strategies in Cable, yesterday’s spike-high could be usable for stop placement, with targets directed towards the daily low of 1.2791 and then the prior area of resistance at 1.2755.

Chart prepared by James Stanley

--- Written by James Stanley, Strategist for DailyFX.com

To receive James Stanley’s analysis directly via email, please SIGN UP HERE

Contact and follow James on Twitter: @JStanleyFX