To receive James Stanley’s Analysis directly via email, please sign up here.

Talking Points:

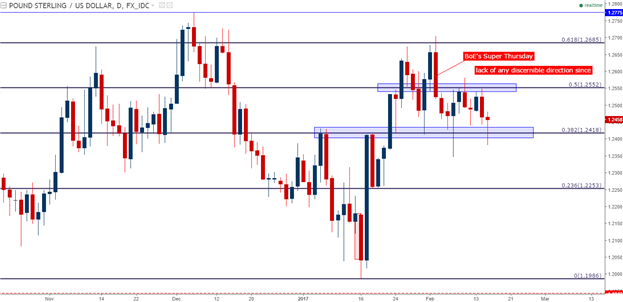

- GBP/USD Technical Strategy: Intermediate-term mixed; Near-term mixed.

- The big driver for the top-side cable move will likely be inflationary pressure, moving the BoE away from dovishness and, perhaps even to a hawkish move in the not-too-distant future. This appears less-relevant, for now, after the most recent BoE Super Thursday.

- If you’re looking for trading ideas, check out our Trading Guides. They’re free and updated for Q1, 2017. If you’re looking for ideas more short-term in nature, please check out our Speculative Sentiment Index Indicator (SSI).

In our last article, we looked at the move-lower in the British Pound after the Bank of England’s Super Thursday batch of announcements. And while the BoE added a healthy increase to their growth forecasts, they coupled this with a cut to inflation forecasts; which removed some of the bullish motivation that was previously-showing in the pair.

At this point, price action on the daily chart of Cable is looking rather direction-less with little to work with while prices hover around the 1.2500- psychological level.

Chart prepared by James Stanley

The fact that the U.S. Dollar has been rather strong for much of February while Cable has been congested could denote the fact that the British Pound has exhibited at least some strength during the month. But this also highlights an issue with the bullish side of the pair at the moment, and that’s one of drivers, or perhaps more accurately, a lack thereof.

What makes the prospect of top-side in Cable really attractive is the idea of rising inflationary after the ‘sharp repricing’ in the British Pound around Brexit and the ensuing dovish-campaign from the Bank of England. While this is all very logical, and has even begun to show, the BoE has appeared unmoved by the threat of rising inflation; indicated most recently when the bank actually downgraded inflation forecasts for 2017 while dramatically increasing their expectations for GDP-growth. And this doesn’t even include the prospect of short-USD exposure that would come-along with long GBP/USD exposure; as Dollar strength has begun to show prominently again throughout February.

So, while this theme, or at least the potential for this theme remains very much alive (given the fact that we’ve seen continued support while USD has been ripping-higher), it does not appear to be a hot-button at the moment and traders would likely want to wait for price action to denote bullish continuation potential before looking to press long-exposure. For such an approach, a top-side break of 1.2580 could open the door for such a theme.

Chart prepared by James Stanley

--- Written by James Stanley, Analyst for DailyFX.com

To receive James Stanley’s analysis directly via email, please SIGN UP HERE

Contact and follow James on Twitter: @JStanleyFX