To receive James Stanley’s Analysis directly via email, please sign up here.

Talking Points:

- GBP/USD Technical Strategy: Long, one target hit, remainder being closed at market.

- Price action has remained strong in the Cable, rising to the April high as of yesterday.

- If you’re looking for more trade ideas, check out our Trading Guides; they’re free.

In our last article, we looked at the coagulated price action that was being seen in GBP/USD. As we had alluded to, when those situations arise there are really only two options, and they are somewhat related: Either a) walk away or b) outline a conditional setup and wait for price to meet your parameters.

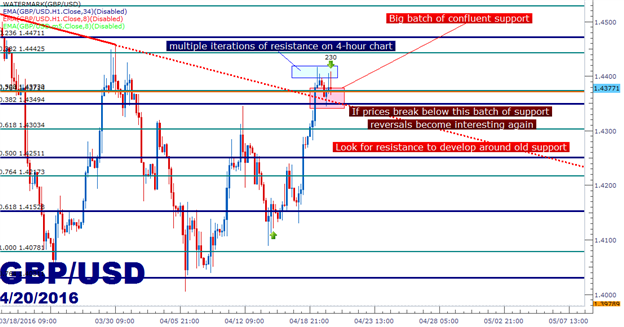

We looked at a conditional setup derived from Fibonacci, and the top-side setup was triggered in the days following that most recent article; looking for support at the 1.4152 level.

The primary point of resistance was at 1.4251, and that level has been soundly broken with very little signs of selling as prices were rising. Price action has ascended through the next batch of resistance at 1.4349-1.4375, and is now trying to find support in this key area on the chart.

This could have the hallmarks of a new trend, with new support being established at old resistance; but rather than push the top-side move, I’m going to close the remainder of the position at market, as we may be seeing a short-side reversal setup beginning to show.

Five of the past seven four-hour candles are showing wicks at 1.4400, a clear sign of selling off of this resistance level; and the daily chart is working on a non-completed spinning top formation. A spinning top or Doji after a big move is indicative of a potential reversal, so this is somewhat trying to prelude a bearish harami setup.

Now, with that being said, there aren’t yet enough clear signs of reversal to trigger the short just yet; merely enough to obviate the preexisting long position. To plot for a short position, traders can watch the current batch of confluent support between 1.4349-1.4371, which includes three different Fibonacci levels over various time frames, as well as a projected trend-line. Should this batch of support yield, traders can then begin looking for resistance to develop in this area before triggering the short position.

Targets for prospective short positions could be set to prior support values at 1.4304, 1.4251, and then again off of 1.4152.

Created with Marketscope/Trading Station II; prepared by James Stanley

--- Written by James Stanley, Analyst for DailyFX.com

To receive James Stanley’s analysis directly via email, please SIGN UP HERE

Contact and follow James on Twitter: @JStanleyFX