To receive James Stanley’s analysis directly via email, please SIGN UP HERE

Talking Points:

- GBP/USD Technical Strategy: Flat

- Later in the week marks the Bank of England’s Super Thursday, which will see a rate decision, meeting minutes, and updated inflation forecasts from the BoE.

- Traders looking to go into Super Thursday may look to bias to the short-side with stops above the 1.5500 zone of resistance, but targets should accordingly be set at least 200% of this stop distance to offset for the heightened risk of going into such a huge news announcement.

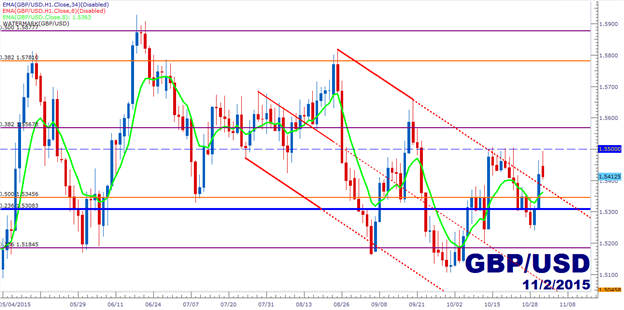

In our last piece, we looked at a short setup in GBP/USD after a trend-channel resistance inflection, combined with the major psychological level at 1.5500 for stop placement. All three targets provided for the short-side were quickly met, as FOMC-driven USD-strength brought the Cable below the vaulted 1.5250 psychological level, albeit temporarily. But USD-weakness on Thursday and Friday of last week propelled GBP/USD right back to the upper trend-line of the resistance channel, eventually giving way to surging prices. The open of this week saw a continuation of that move, as GBP/USD put in a near-term top just shy of the 1.5500 psychological level that had provided ‘brick-wall-like’ resistance just last week. With an extremely heavy day of data on the calendar for Thursday, traders may be best served by waiting on setups in GBP-pairs unless anything is especially attractive.

The near-term direction here would be convoluted, to say the least. While last week’s lows at 1.5245 could be considered a ‘higher-low,’ this morning’s failure to break above 1.5500 could be construed as a ‘lower-high,’ leading into that undesirable, wedge-like price action that merely shows congestion in a market. To be sure, this is emblematic of a heavy data-day on the calendar, as you’re not the only trader that wants to control risk going into a big release; markets will often funnel ahead of the news as risk-taking wanes ahead of the ‘big driver.’ This Thursday marks ‘Super Thursday’ for the Bank of England. We will get an interest rate decision (no move is expected), meeting minutes (which could be telling towards when a move COULD be expected) and final inflation forecasts (which will likely be the determinant towards when a hike will be expected).

With such a huge docket of news set for later this week, traders would likely want to look for larger risk-reward ratios to offset this heightened risk environment. For this purpose, the short-side could appear more attractive, as resistance in the 1.5500 area could provide an adequate level of risk management. Traders could look to lodge stops just above this major psychological level, with targets at 1.5308, which is 23.6% of the ‘big picture move’ in GBP/USD, taking the 2007 high to the Financial Collapse low. This could afford a 1-to-2 risk-to-reward ratio, which should be the minimum given the extreme risk that may ensue. Should 1.5300 come into play, additional short-side targets could be cast towards 1.5250 (major psychological level), 1.5184 (23.6% retracement of the most recent major move), and then 1.5000 even (major psychological level).

Alternatively, the long side could be worked with if we get support on the top-side of the projected trend-channel that had assisted with the last short entry. Should support come in at this region, projecting approximately to ~1.5375 for tomorrow’s Daily candle, then we could have an instance of ‘old resistance as new support,’ and this could provide motive for top-side triggers. Traders would likely want to wedge stops below that 1.5308 level mentioned previously, with targets set to 1.5500, 1.5567 (38.2% Fib retracement of the most recent major move), followed by 1.5650 (prior price action swing-high), and then 1.5750 (major psychological level).

Created with Marketscope/Trading Station II; prepared by James Stanley

--- Written by James Stanley, Analyst for DailyFX.com

To receive James Stanley’s analysis directly via email, please SIGN UP HERE

Contact and follow James on Twitter: @JStanleyFX