EUR /JPY and GBP/JPY Technical Analysis

- Euro and British pound price action against Japanese Yen

- EUR/JPY and GBP/JPY price charts

See Our latest trading guides for free and discover what is likely to move the markets through Q4 of this year.

GBP/JPY, EURJPY – More Consolidation

On Friday, EUR/JPY downtrend move corrected higher and created a higher low at 119.66. This week, the pair recovered all losses however, has not been able yet to revisit last week high, reflecting less buyers joining the market.

On the other hand, on Friday GBP/JPY corrected lower and created a lower low at 139.32. This week, the price rallied to 141.86 – its highest level in nearly six and half months.

The Relative Strength Index (RSI) remained flat above 50 on both pairs, highlighting weak buyers in a bullish market.

Having trouble with your trading strategy? Need a hand? Here’s the #1 Mistake That Traders Make

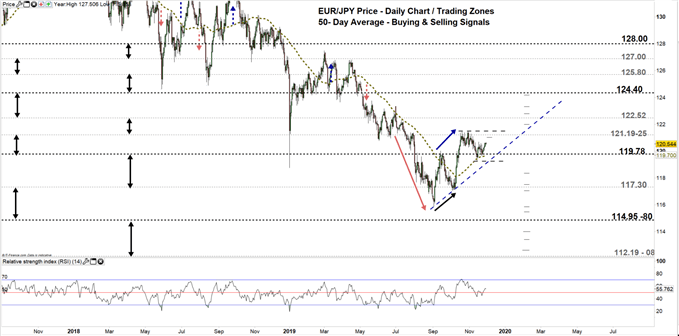

EUR/JPY Daily PRice CHART (Sep 2, 2017 – Nov 29, 2019) Zoomed Out

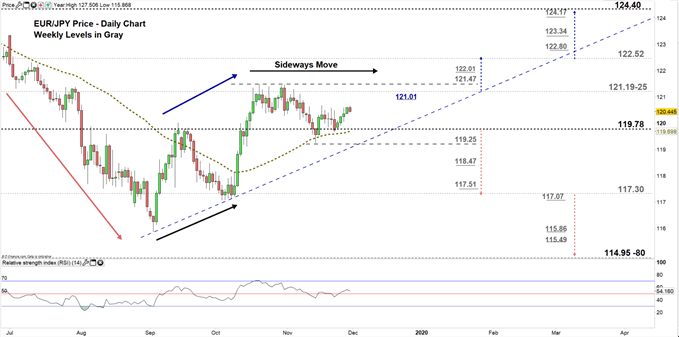

EUR/JPY Daily Price CHART (July 1 – Nov 29, 2019) Zoomed in

Looking at the daily chart, we notice on Monday EUR/JPY rallied back to the trading zone 119.78 – 121.19. Hence, buyers may push for a test of the high end of the zone contingent on clearing the daily resistance level underlined on the chart.

A close above the high end may convince more buyers to join the market and push towards 122.52. Although, the upside move could weaken at the weekly resistance levels marked at the chart as some buyers might take profits at these levels.

On the flipside, a close below the low end of the zone would mean buyer’s hesitation and could open the way for sellers to take charge and press towards 117.30. Nevertheless, the weekly support levels underscored on the chart should be considered, as they could be possible exit points for some sellers.

Just getting started? See our Beginners’ Guide for FX traders

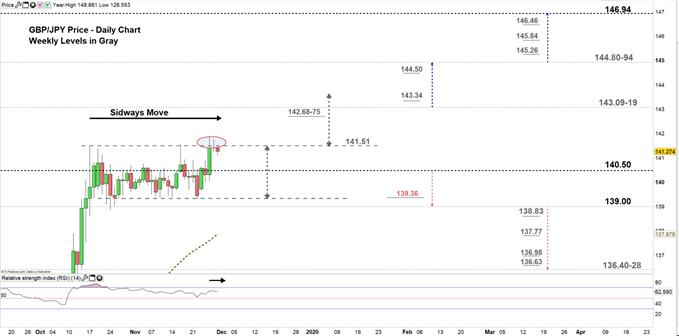

GBP/JPY Daily PRice CHART (Nov 20, 2017– Nov 29, 2019) Zoomed Out

GBP/JPY Daily PRice CHART (Sep 23 – Nov 29, 2019) Zoomed In

From the daily chart, we notice on Tuesday GBP/JPY rallied back to the higher zone 140.50- 143.09. The price could be on its way for a test of the high end of the zone. Although, buyers should clear first the weekly resistance area marked on the chart.

It’s worth noting that, buyers failed to keep rallying the price above the upper line of the rectangle pattern. Yet, if GBPJPY breaks and remains above 141.51 this could lead the price to rally above 143.50.

Additionally, a close above 143.19 could embolden buyers to keep pushing GBPJPY towards the vicinity of 144.80-94.

That said, any close below the low end of the zone would mean buyer’s pullback and exit from the market. This could lead the price towards 139.00. Further close below this level could open the door for sellers to take the lead and press towards the vicinity of 136.40-28. In that scenario, the daily and weekly support levels underlined on the chart should be kept in focus.

Join Me on Friday, DEC 6 at 14:00 GMT. In this session we will talk about most common directional and momentum indicators and how to use them

Written By: Mahmoud Alkudsi

Please feel free to contact me on Twitter: @Malkudsi