Technical Analysis

All eyes on UK Prime Minister Theresa May meeting the 1922 Committee.

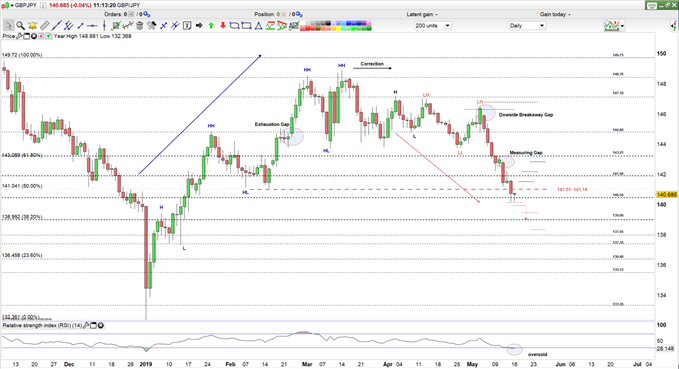

GBP/JPY Daily Chart highlighting a trend reversal.

See the Q2 GBP and JPY forecast s to learn what is likely to drive price action through mid-year!

See the DailyFX Economic Calendar for a comprehensive look at all key data releases.

GBP/JPY Daily Price Chart (Oct 18 – May 16, 2019)

Negative Break to The Downside

Since early Jan GBP/JPY has been trading to the upside from the higher-high created on Jan 25 at 144.84, to Feb 7 higher low at 141.01. On Feb 25 the pair opened with an exhaustion gap indicating that the uptrend would end soon.

GBP/JPY started to correct this movement on April 3 carving a lower high at 147.20 and a higher low on April 9 at 144.78, then to start a bearish movement creating on April 12 another lower high at 147.01 with a lower low on April 25 at 143.76.

On May 6 bearish momentum gained strength when the price opened with a breakaway downside gap, starting a sell-off so the price closed on May 10 at 142.98. On Monday GBP/JPY opened with a measuring gap at 142.77 encouraging the pair to move further to the downside breaking below the levels mentioned in last week article 141.90 and the 141.04 – 140.94 zone.

Read more in: Significant Trading Levels and Zones

Alongside this development it’s worth noting the Relative Strength Indicator (RSI), pointing lower since May 10, dipped yesterday below 30 into oversold territory.

Summary: Since yesterday GBP/JPY has been flirting with 140.50 therefore, if the price closes below the bearish movement might continue hinting towards 139.00. Support levels at 140.14, 139.94 and 139.47 are worth monitoring. If GBP/JPY closes above 140.50 it suggests the pair could rally towards the higher end of the trading range at 141.90 contingent on prices breaking through the resistance zone at 141.01 – 141.14 and then 141.53.

GBP/JPY will move to a higher trading range if it closes above 141.90.However, the pair need to clear resistance levels at 142.19 and 142.84 before testing 143.21.

Just getting started? See our beginners’ guide for FX traders

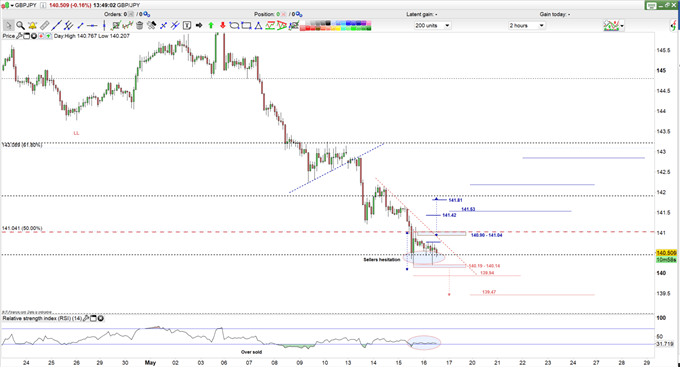

GBP/JPY 2 Hours Price Chart (May 16, 2019)

Sellers Hesitation

Yesterday, GBP/JPY closed below 141.01 and headed towards 140.50.However, the price failed twice to close below this level. Today, the pair also failed twice to close below 140.50 and accompanied with RSI pulling back from the oversold territory to 34, this may reflect seller hesitation at this stage.

If buyers can take the initiative back and push GBP/JY above the140.90 – 141.04 zone, the next level of significant resistance is at 141,81. Resistance levels at 141.42 and 141.53 need to be monitored.

If bearish momentum gains strength and GBP/JPY break below the140.19 -140.14 zone, the pair could swing lower pushing towards 139.47 contingent on clearing support level at 139.94.

Written By: Mahmoud Alkudsi

Please feel free to contact me on Twitter: @Malkudsi

Having trouble with your trading strategy? Here’s the #1 mistake that traders make