To receive James Stanley’s analysis directly via email, please SIGN UP HERE

Talking Points:

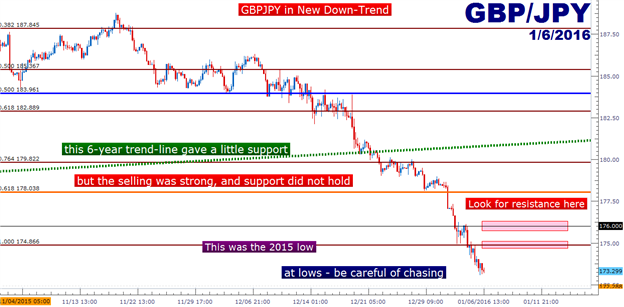

- GBP/JPY Technical Strategy: Flat

- We looked at a potentially new down-trend last week, and prices haven’t stopped surging lower since.

- We’re in one of those rare situations in which the fundamentals and technicals appear to be nicely aligned. Risk management is still a necessity, so should resistance develop, traders can look at that for a risk-efficient way to join the move.

In our last article, we asked the very pertinent and timely question for GBP/JPY: Had a new down-trend emerged? After the other-worldly move higher from April to June of last year in which GBP/JPY gained 2,000 pips in a little over two months, there were plenty of reasons to remain bullish. That move was driven by a rare alignment of fundamental and technical themes that amounted to a rip-roaring up-trend. But since that high was set in the middle of last year, both the British Pound and Japanese Yen have stumbled upon some varying prospects.

Whereas continued Yen weakness was once a predominant expectation for the Bank of Japan, those prospects are looking much less likely after the December BoJ meeting. And in the case of the British Pound, we spent much of last year waiting for the end of the year for the inflation picture for the Bank of England to ‘come into better focus.’ Well, Super Thursday threw that wrench for a loop after the Bank took a decidedly dovish stance towards future rate hikes.

So we’ve seen a near complete reversal of fortunes. Sterling strength and Yen weakness are no longer looking that likely, and many traders are expecting the exact opposite.

All of this is fine and well, but it’s the chart that shows traders what matters most. And up until mid-December, there was still reason to keep on believing that the up-trend would return to GBPJPY. We looked at an aggressive top-side reversal setup two weeks ago based around this premise. At the time, GBPJPY had just run down to a six-year trendline that just happened to be confluent with the major psychological level of 180.00. There was also a Fibonacci level 20 pips below that batch of support that was the 76.4% retracement of the 2015 range in GBPJPY. When these types of setups present themselves, they can offer significant attractiveness in that the trader can try to get into a position to risk $1 to make $2 or $3. Should that support hold, fantastic. If it doesn’t, lose small. Not doing this is falling into the trap of the Number One Mistake that Forex Traders Make.

This is a great example of risk management at work. By eating a quick stop as soon as the trader knows that they’re wrong, they’re then free to embark upon new trends and fresh setups. Too many traders hold onto positions to simply prove that they were ‘right’ at some point in the past.

When that thicket of support was violated by falling prices, it began to appear as though a new down-trend had emerged, and that’s what we discussed in our previous piece. Moving forward, traders can look to get short by waiting for a retracement to move prices back towards resistance (previous support) in the effort of finding a risk-efficient entry in the direction of the new trend. The more attractive level to look for such a play would be that 2015 low that had provided a brief amount of support on Monday, and then offered a quick dose of resistance today. Should this level of 174.86 come into play, traders can look for a top-side wick on the hourly or four-hour chart to indicate near-term reversal.

If resistance doesn’t develop at 174.86, the next level of interest would become 176, as this was the Monday close/Tuesday open, and we’ve seen two separate instances of resistance in this neighborhood before the most recent leg of this down-trend emerged.

Created with Marketscope/Trading Station II; prepared by James Stanley

--- Written by James Stanley, Analyst for DailyFX.com

To receive James Stanley’s analysis directly via email, please SIGN UP HERE

Contact and follow James on Twitter: @JStanleyFX