Talking Points:

- CAC 40 Hits Resistance in the Short Term

- Resistance Found at the 10 DAY EMA at 5,343.37

- Sentiment Figures Remain Off Extremes

The CAC 40 and other European equities markets are remaining quiet this morning, as traders await ECB’s Mario Draghi speaking in Madrid later in the session. So far the CAC 40 is trading up +0.35% for Wednesday’s trading. Top gainers for the session include Carrefour (+2.32%) and Accor (+1.03%). Top Losers for today’s trading include both Michelin (-2.56) and Vivendi (-0.98%).

Technically, the CAC 40 is trading back to a key value of resistance at the 10 day EMA (exponential moving average) found at 5,343.37. A move above this values should be seen as significant, as it would suggest that market momentum is turning higher in the short term. In a bullish scenario, traders may next look for the Index to challenge last Wednesday’s high of 5,395.70. If prices are rejected at present levels however, traders may next look for the CAC 40 to challenge the standing monthly low at 5,238.40.

CAC 40, Daily Chart with Averages

Want to learn more about trading with market sentiment? Get our Free guide here.

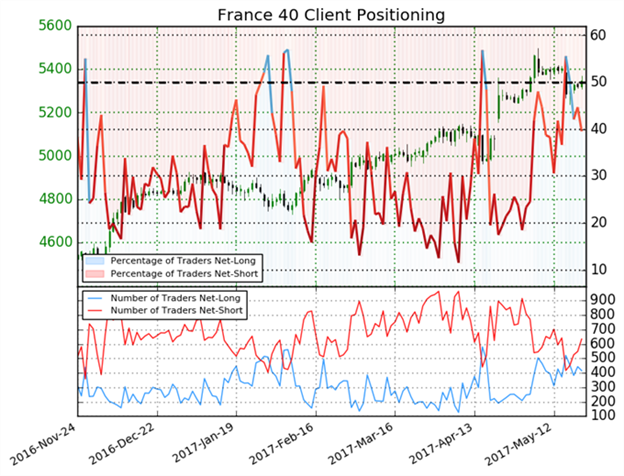

Sentiment totals for the CAC 40 (Ticker: France 40) reads net short for Wednesday. With IG Client sentiment reading at -1.53 with 39.6% of traders net-long the market. Traders should note that this value has recently flipped net-short, after a brief period net-long last week. If the CAC 40 continues to trade back towards new highs, it would be expected to see IG Client Sentiment shift to new negative extremes of -2.0 or more. However if prices decline to monthly lows, sentiment values may neutralize and flip to a positive reading.

--- Written by Walker, Analyst for DailyFX.com

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page.

Contact and Follow Walker on Twitter @WEnglandFX.