Talking Points:

- CAC 40 Breaks Above Critical Resistance at 4,500.00

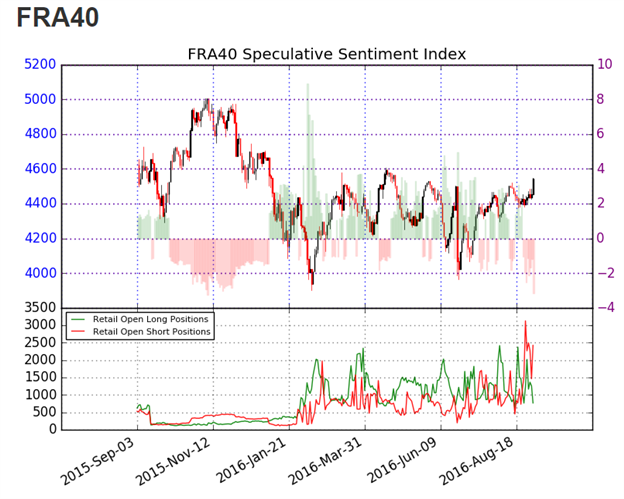

- Sentiment Totals Remains Extreme with SSI Reading at -3.14

- If you are looking for more trading ideas for equities markets, check out our Trading Guides

The CAC 40 has closed the week higher, trading up +2.31% in today’s session. Leading the CAC 40 advance is Veolia Environment, which has closed the session up +4.90%. Today’s breakout is technically significant as the Index is to not only close the week above 4,500, but will also close above the June 2016 high of 4,538.00. Traders looking for continued bullish momentum may now set their sights on the April 2016 high of 4,616.50 followed by the standing yearly high of 5,218.00.

CAC 40, Daily Chart

Traders tracking sentiment should note that current ratio of long to short positions for the CAC 40 (Ticker: FRA40) stands at -3.14. With only 24% of positioning long the market, this SSI reading is considered extreme. Typically, when SSI is negative, it suggests that the market may be prepared to trade higher. In the event that the CAC 40 continues to trade higher, it would be expected to see SSI remain at negative extremes. Alternatively, if today’s move proves to be a false breakout, it would be expected to see SSI trade back towards more neutral values.

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page.

Contact and Follow Walker on Twitter @WEnglandFX.