Talking Points

- CAC 40 Trades Lower for the Third Consecutive Session

- Current Support for the CAC 40 is Found at 4,331.69

- If you are looking for more trading ideas for stock indices, check out our Trading Guides

The CAC 40 is now poised to close lower, as the Index is now trading down -1.07% on the session. Today’s decline is being led by Societe Generale which is trading down -2.89%. Only five of the listed forty companies are trading higher, with Klepierre trading up +1.12%. Traders should note that a lower close today, would mark the third consecutive losing session for the CAC 40.

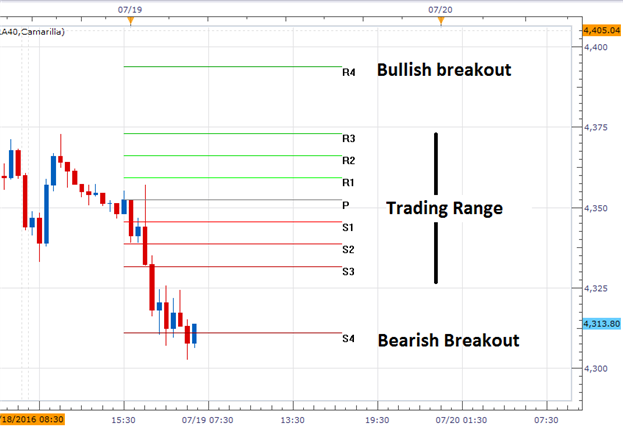

CAC 40, 30 Minute Chart

(Created using Marketscope 2.0 Charts)

Technically the CAC 40 is finding support at the S4 Camarilla pivot point, found at a price of 4310.98. If prices remain supported here, traders may see the Index bounce and begin to pare previous losses. A move back inside of the trading range, beginning at the S3 pivot at 4,331.69, would signify a significant change from the current bearish market conditions. Alternatively, if prices continue to decline, traders may look for a continuation breakout under the S4 pivot. In this scenario traders may look for the CAC 40 to test other values of support, which include the psychological 4,300 level.

Find out real time sentiment data with the DailyFX’s sentiment page.

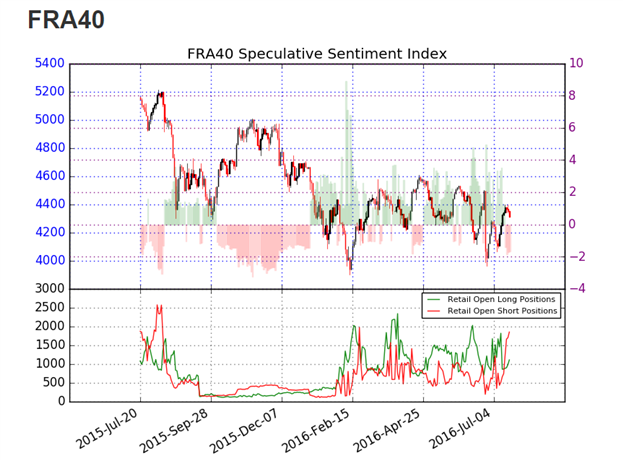

Sentiment for the CAC 40 (Ticker: FRA40) has come off last weeks extremes with SSI (speculative sentiment index) reading at -1.29. This value remains negative however, and with 56% of positioning short, SSI suggests that the CAC 40 may be prepared to trade higher. If prices do trade higher, SSI may shift towards a more negative extreme. Alternatively if prices break under support, traders may look for SSI to move back towards more neutral readings, or flip positive.

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page.

Contact and Follow Walker on Twitter @WEnglandFX.