Talking Points

- The CAC 40 Trades Down -.63%

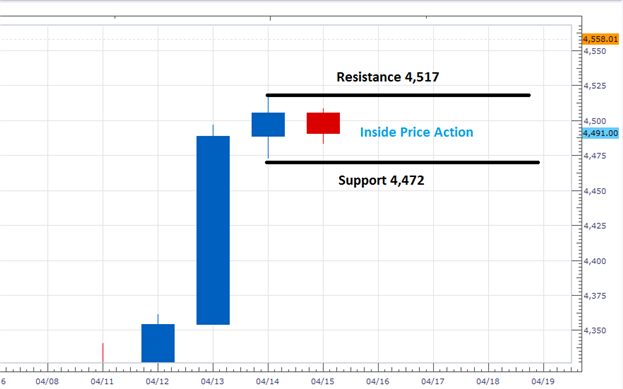

- Daily Price Consolidates Inside of Support & Resistance

- SSI Reads at +1.2

CAC 40 Daily Chart

(Created using Marketscope 2.0 Charts)

What is next for the equities market? Click HERE for our analysts Free forecast!

The CAC 40 is trading lower this morning, and is currently down -.63% on the day. The index is currently trading just under this month’s high, which was printed yesterday at a price of 4,517. It is important to note that the CAC 40 is also set to close the week with an inside bar. With price action failing to breakout to a new high, yesterday’s daily high is currently acting as resistance. Conversely, price action has also filed to breakout below yesterday’s low. This low is currently acting as support of the Index and can be found in the image above at 4,472.

In the event that the CAC 40 breaks to a new high or low, traders may use ATR to plan potential price projections for the Index. Currently 1X daily ATR reads at 82. This places bullish breakout projections near 4,599. Alternatively, bearish breakout targets may be tentatively be found near 4390. If prices fail to breakout on Monday’s open, it may signal further consolidation in global equities markets. In this scenario, traders may wait for a breakout to enter into the market, or opt to look for range trading opportunities as the CAC 40 continues to trade between support and resistance.

SSI (speculative sentiment index) for the CAC 40 (Ticker: FRA40) is currently reading +1.2. This value has increased significantly from Wednesday’s reading of -1.66. This flip in sentiment is significant, as it has coincided with the CAC 40 printing new monthly highs. If prices reverse and break lower, traders should watch SSI to reach for an extreme of +2.0 or higher. Conversely, if prices move towards higher highs, it would be expected to see SSI flip back to a negative value.

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page.

Do you know the biggest mistake traders make? More importantly, do you know how to overcome the biggest mistake? Read page 8 of the Traits of Successful Traders Guide to find out [free registration required].

Contact and Follow Walker on Twitter @WEnglandFX.