Talking Points

- CAC 40 Approaches Resistance Near 4,536.89

- Equities Markets Await Yellens Speech for Insight on FOMC Event

- SSI Reads at +1.38, with 58% of Positioning Net Long

CAC 40 Daily Chart

(Created using Marketscope 2.0 Charts)

What’s next for equities market? Find out more with our analysts Free forecast!

The CAC 40 continues to trade near weekly highs this morning, however price is little changed with the Index trading up .02%. The CAC 40’s top moving stock on the day is Credit Agricloe, which is now trading down -5.11%. Many equities traders are eagerly awaiting a speech from Janet Yellen later today at 1:15 p.m. ET. While it is not expected that Yellen will speak definitively about any upcoming Fed events today, her insights however may give traders more reason to speculate on the likelihood of a potential rate hike for Junes FOMC event.

Price action for the CAC 40 is now trading higher for the fourth consecutive session. This bullish momentum has continued since the Index broke free from a previously mentioned consolidating trading range. Now as prices advance, traders may begin looking for potential points of resistance. For today’s trading that includes a 78.6% Fibonacci retracement found at 4,536.89. This value has been found by measuring the distance from the previous swing high at 4,616.50 to the current swing low at 4,301.30. In the event that prices break above this retracement value, traders will look for prices to continue upward, and potentially put a new higher high in place.

Alternatively, if the CAC 40 finds resistance here, it would suggest that this week’s bullish momentum is part of a broader retracement in an ongoing downtrend. In this bearish scenario, traders may again look for prices to break back inside of the previously identified range. A further decline below 4,244.50 would suggest a change in momentum for the Index, and open the CAC 40 to resume its 2016 downtrend.

Find out real time sentiment data with the DailyFX’s sentiment page.

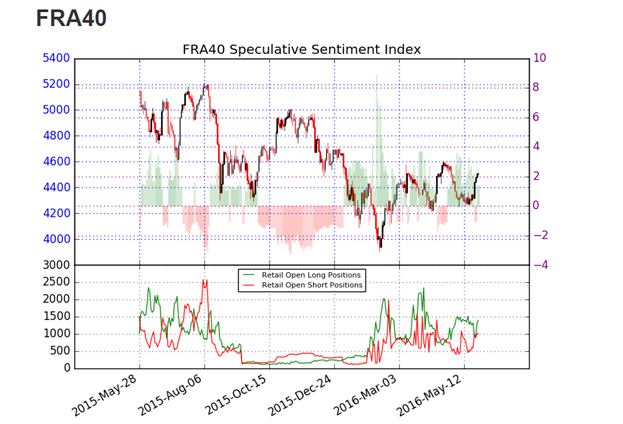

SSI (speculative sentiment index data for the CAC 40 (Ticker: FRA40) continues to read positive with the ratio of long to shorts at +1.38. When taken as a contrarian signal, 58% of positioning long suggests that there is a small bias for further price declines. However, since this value has grown less net long from yesterday reading of +1.44, it may suggests a change in momentum. If prices continue to advance, traders should look for SSI to potentially decline and flip to a negative value.

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page.

Contact and Follow Walker on Twitter @WEnglandFX.