Talking Points

- The CAC40 Breaks to a New Monthly Low

- Bearish Targets Include the October 2015 Low at 3,786

- SSI Reads at +1.69

CAC40 30 Minute Chart

(Created using Marketscope 2.0 Charts)

What is in store for the Euro in 2016? See our Analyst forecast here !

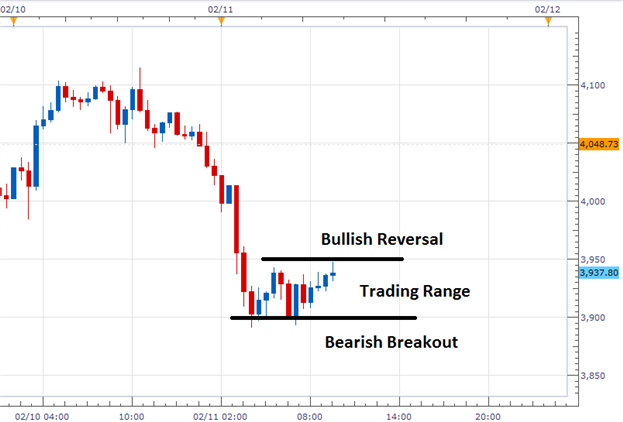

The CAC40 is consolidating this morning, after first breaking out to a new weekly low under 3,950. As seen in the graph above the Index is now ranging between short-term resistance near 3940 and support, which is found near 3,900. As this range develops, traders looking to join the CAC40’s prevailing downtrend may wait for a fresh breakout in price below support. In this bearish scenario, traders may look for the Index to continue to decline, and next challenge the October 2015 low, which stands at 3,786.

In the event that prices fail to decline, and breakout above resistance, this may temporarily suspend any further downtrend momentum for the CAC40. In the event of a bullish price reversal, traders may look for prices to challenge values of resistance, which include daily values at 4,035 and 4,089. A move above these values would be considered significant as it would suggest that a larger reversal or bullish retracement may be in store for the Index.

SSI (Speculative Sentiment Index) for the CAC40 (Ticker FRA40) is currently reading at +1.69. While this value is negative, it is not as extreme as last week’s reading of +3.41. When read as a contrarian signal, current CAC40 SSI reads as a bearish signal. However is sentiment readings continue to decline, it may suggest a potential change in the Indices ongoing downtrend.

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page.

Do you know the biggest mistake traders make? More importantly, do you know how to overcome the biggest mistake? Read page 8 of the Traits of Successful Traders Guide to find out [free registration required].

Contact and Follow Walker on Twitter @WEnglandFX.