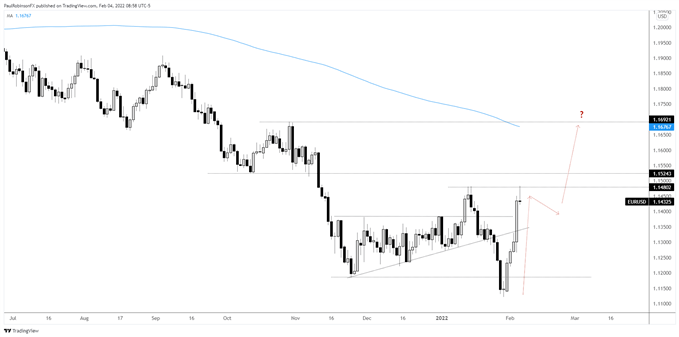

EUR/USD Technical Highlights:

- EUR/USD surprising weekly rise suggests big low could be in

- There a couple of ways this could play out, but bias is bullish

- Will take swift reversal lower to dent outlook

The EUR/USD has been full of surprises the past few weeks. It began with a fake-out breakout in mid-Jan (that we viewed with a wary eye) followed by a hard drop lower (that looked like the real move). But the move off the low the past week has been the real surprise, and one that suggests we may have seen a significant low.

It’s not just the power of the move off the low that suggests we may have seen a meaningful bottom, it’s the proceeding price action coupled with it that makes what is happening so interesting.

EUR/USD went totally dead for about two months then suddenly awoken with a sudden move higher, sharp move lower that was then reversed with the biggest up week (as of the time of this writing) since the early days of pandemic chaos. This all coming after a year-long downtrend.

In the near-term, we may see a little backing-and-filling after this week’s surge, but the shallower the better in terms of conviction on the notion that we have seen a meaningful low. Nevertheless, even if we don’t see immediate momentum right now more upside still looks likely after recent events.

There is some resistance just ahead around 11480 that the Euro needs to get through. A consolidation period under could do some good for setting the table up for solid risk/reward entries. The next level to watch is 11524, but the 200-day moving average at 11676 and declining is the next real level coming to mind.

If the EUR/USD were to crater from here, taking back half or more of the recent gains in sudden fashion, then that would warrant a neutral stance on the bullish outlook.

EUR/USD Daily Chart

EUR/USD Charts by TradingView

Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX