Euro, EUR/USD, Retail Trader Positioning - Technical Forecast

- EUR/USD looks toppy, but follow-through has been lacking

- Numerous bearish technical warning signs seem to persist

- But, rising Euro short bets from retail traders hint otherwise

Euro Technical Outlook

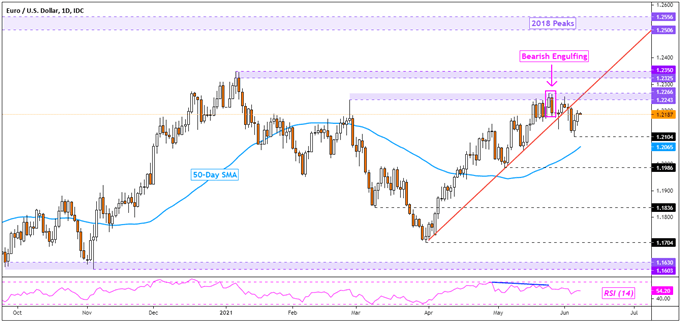

The Euro is attempting to regain its footing against the US Dollar after multiple bearish technical warning signs hinted that EUR/USD was about to top. For starters, a Bearish Engulfing candlestick emerged last month as prices tested the 1.2243 – 1.2266 resistance zone. Negative RSI divergence was showing that upside momentum was fading. That can at times precede a turn lower.

Then, the pair closed under the rising trendline from late March. But, follow-through was and still appears to be lacking. Prices left behind key support at 1.2104. Resuming last month’s top would entail pushing under this level. That is where the 50-day Simple Moving Average may maintain the dominant focus to the upside. Uptrend resumption could send prices towards December peaks, between 1.2325 and 1.2350.

EUR/USD Daily Chart

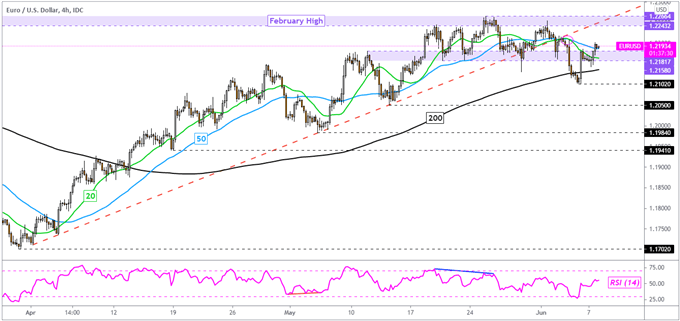

Zooming in on the 4-hour chart reveals a bearish ‘Death Cross’ between the 20- and 50-period SMAs. This is as prices are consolidating around the 1.2158 – 1.2181 inflection zone. Last week, the 200-period SMA maintained the dominant upside focus, it may again in the event of a near-term turn lower. As such, the Euro’s position seems neutral, which is a change of pace from what April and most of May entailed. Extending last month’s top could expose the May 13th low at 1.1984. Under that sits the April 19th low at 1.1941.

EUR/USD 4-Hour Chart

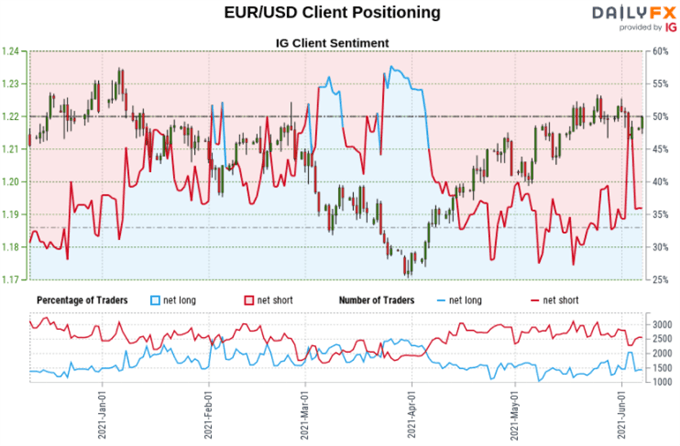

The IGCS gauge shows that about 35% of retail investors are net-long EUR/USD. Downside exposure has increased by 12.37% and 2.39% over a daily and weekly basis respectively. The fact the majority of retail traders are net-short suggests EUR/USD may rise. The combination of current sentiment and recent changes further bolsters a bullish tone.

Euro Retail Trader Positioning

--- Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter