EUR/USD Price Technical Outlook

Bears Lead EUR/USD to Multi-Month Low

On Friday, Euro weakened further against US Dollar and printed its lowest level in over two and half years at 1.0827, then close the weekly candlestick in the red with 1.0% loss. This week, EUR/USD retreated even more and broke below 1.0800 handle.

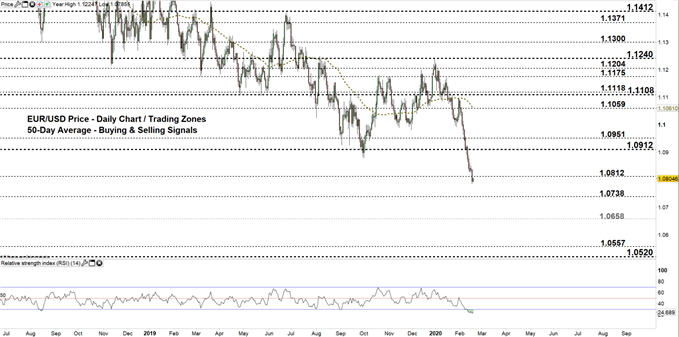

Alongside that, the Relative Strength Index (RSI) remained in oversold territory emphasizing the strength of downtrend momentum.

EUR/USD Daily PRice CHART (JULY 1, 2018 – FEB 19, 2020) Zoomed Out

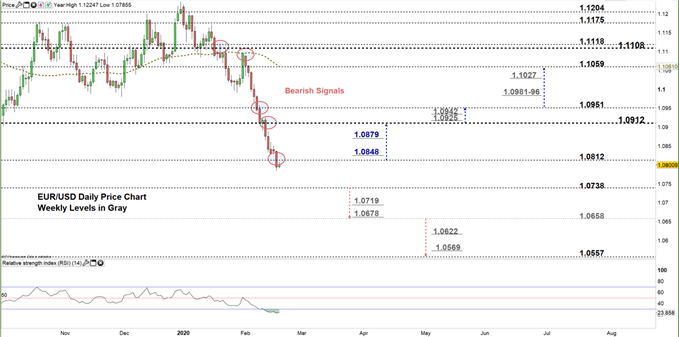

EUR/USD Daily Price CHART (Sep 25 – FEB 19, 2020) Zoomed in

Looking at the daily chart, we notice in mid-January EUR/USD broke below 1.1108 then failed twice to overtake this level generating the first bearish signal. In late January, the pair closed below the 50-day average providing another bearish signal. Since then, the market has been in a free fall as discussed in our last update, declining from a trading zone to another.

Yesterday, the price moved to a lower trading zone 1.0738- 1.0812 eyeing a test of the low end of it. Thus, a close below the low end could encourage bears to press towards 1.0658. Further close below this level opens the door for more bearishness towards 1.0557. In that scenario, special attention should be paid at the weekly support levels underlined on the chart (zoomed in) as some traders might exit/join the market around these points.

In turn, any close above the high end of the zone means bears hesitation.This could lead some of them to exit the market reversing EURUSD direction towards 1.0912. A close above this level could cause a further rally towards 1.0951. That said, the daily and weekly resistance levels marked on the chart should be considered.

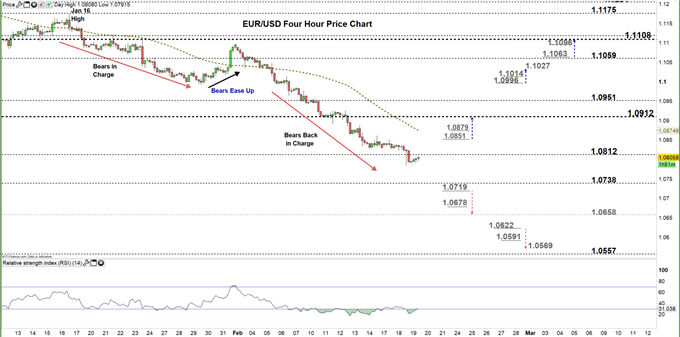

EUR/USD four Hour Price CHART (DEC 16 – FEB 19, 2020)

From the four-hour chart, we noticed last month EUR/USD bears took charge and pressed the price below 1.1000 handle. In early February, bears eased up allowing the market to correct the downtrend move as carved out a higher low at 1.1035. Yet, in Feb 6 the market resumed bearish price action creating lower highs with lower lows.

Therefore, a break below 1.0719 could send EURUSD towards 1.0658. Although, the weekly support level underlined on the chart should be kept in focus. On the other hand, a break above 1.0851 could cause a rally towards 1.0912. Nevertheless, the daily resistance level printed on the chart should be watched closely.

See the chart to know more about key technical levels in a further bullish/bearish scenario.

Written By: Mahmoud Alkudsi

Please feel free to contact me on Twitter: @Malkudsi