EUR/USD Technical Forecast

EUR/USD – Multi Month High

Yesterday, EUR/USD ended its sideways move and rallied to 1.1200 – its highest level in four months. Today, the price dropped slightly on the back of buyers taking profit.

This week, the Relative Strength Index (RSI) pointed higher from 51 to 68 emphasizing that buyers are in control.

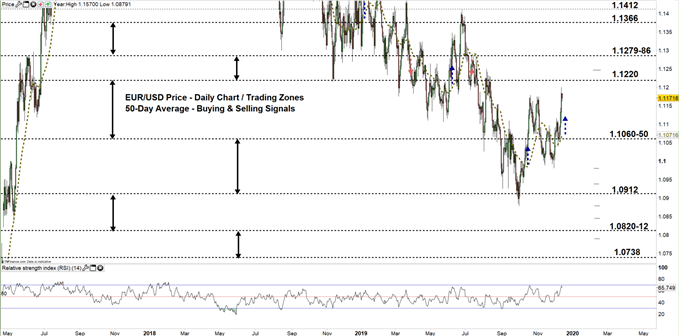

EUR/USD Daily PRice CHART (Mar 31, 2017 – DEC 13, 2019) Zoomed Out

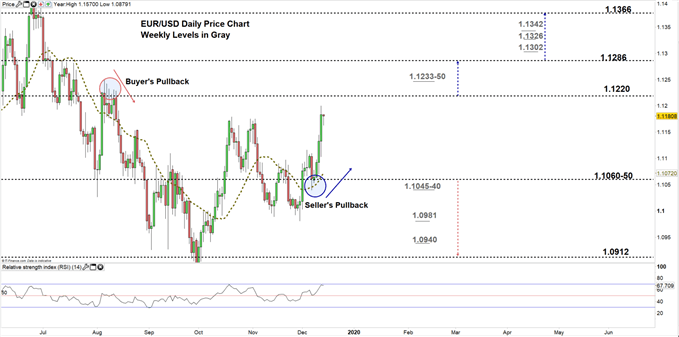

EUR/USD Daily Price CHART (July 25 – DEC 13, 2019) Zoomed in

Looking at the daily chart, we notice on Dec 6 pressed EUR/USD below the 50-Day average. However, the price rallied after and remained in current trading zone 1.1050- 1.1220 as some sellers pulled back i.e. exited the market. Since then, the pair has surged eying a test of the high end of the zone.

A close above the high end of the zone opens the door for market’s participants to push towards the vicinity of 1.1286. Further close above this level could mean more bullishness towards 1.1366. Nevertheless, some buyers would exit at the weekly resistance levels and area marked on the chart (zoomed in).

That said, any failure in closing above the high end of the zone may repeat the mid-August scenario i.e. buyer’s pullback. In this case, EUR/USD could reverse course towards the low end of the zone.

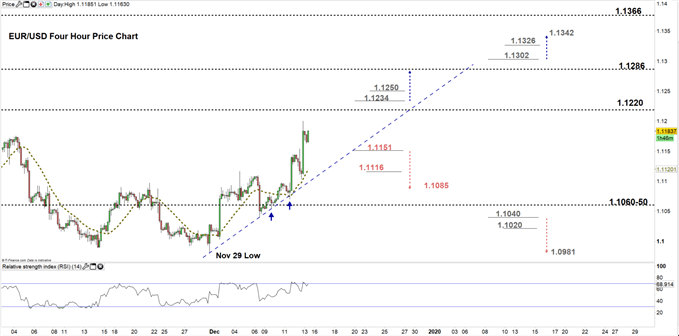

EUR/USD four Hour Price CHART (Nov 4 – DEC 13, 2019)

This week the price tested twice the uptrend line originated from the Nov 29 low at 1.098. However, buyers kept the pair trading above this line providing another bullish signal on the four-hour chart. Therefore, any fall below this line could lead EUR/USD to correct lower.

A break below 1.1151 may send EURUSD towards 1.1085. Although, the daily support level underlined on the chart should be considered. On the other hand, a break above 1.1234 could push the price towards 1.1286. Yet, the weekly resistance level underlined on the chart should be monitored.

See the chart to know more about key levels the price would encounter in a further bullish/ bearish move.

Just getting started? See our Beginners’ Guide for FX traders

Written By: Mahmoud Alkudsi

Please feel free to contact me on Twitter: @Malkudsi