EUR/USD Technical Highlights:

- EUR/USD price sequence suggests new lows fairly soon

- French election gap-fill and 19-yr trend-line lie below

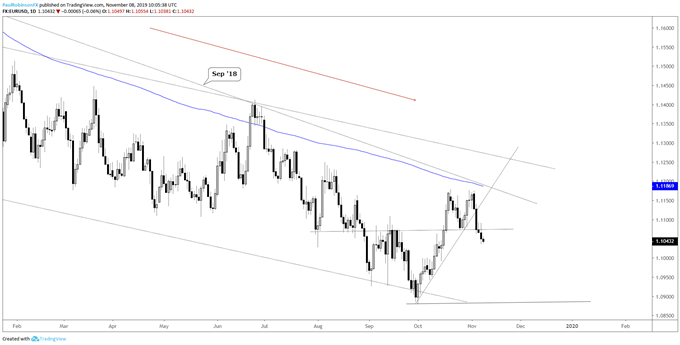

EUR/USD price sequence suggests new lows fairly soon

In this low volatility environment, the Euro continues to have the same old look it’s had for well over a year, that is bumping its way lower, never really garnering any significant amounts of momentum. This may very well continue to be the case, at least for a little while longer.

The recent rise didn’t quite make it to the 200-day, September 2018 trend-line before faltering. The Tuesday break of the trend-line off the October low, along with a breach of 11067 tilts the field back in favor of those looking for lower prices ahead.

It won’t likely be a momentum-driven move lower, one rather that sort of ‘bumps along’, but nevertheless the path of least resistance for now is clear. It was never really in doubt, but the timing of the next wave of selling was yet to be determined until this week’s support break.

If we are to see the familiar sequence of fresh cycle lows develop, in the next few weeks we should see last month’s low at 10879 tested and broken. This is seen as finally bringing the long-awaited gap-fill from the French election in April of 2017. To top of the gap was tested in October, but the actual fill won’t happen until EUR/USD trades down to 10724.

Also, right in that vicinity is a trend-line rising up from 2000, passing under the 2016 low. The confluence of the gap-fill and trend-line are likely to create a very strong level of support that may put in a larger cycle low. We’ll see how the Euro reacts down there should it get there soon.

It will take a lot of work to negate a bearish view with the chart so firmly pointed lower. A break above the recent high at 11179, 200-day, and the September trend-line, all in confluence, will be needed for starters. For now, running with a bearish bias until it stops working.

EUR/USD Daily Chart (broke upward trend, support, new lows look next)

Trading Forecasts and Educational Guides for traders of all experience levels can be found on the DailyFX Trading Guides page.

EUR/USD Weekly Chart (French election gap-fill, 2000 trend-line)

***Updates will be provided on the above thoughts and others in the trading/technical outlook webinars held at 1030 GMT on Tuesday and Friday. If you are looking for ideas and feedback on how to improve your overall approach to trading, join me on Thursday each week for the Becoming a Better Trader webinar series.

Resources for Forex & CFD Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX