EUR/USD TECHNICAL ANALYSIS: BEARISH

- Euro issues lowest daily close of the year, aims to challenge 2019 low

- Closing the month below 1.0980 portends deeper losses in September

- Rebound above 1.1159 needed to invalidate near-term selling pressure

Get help building confidence in your EUR/USD strategy with our free trading guide!

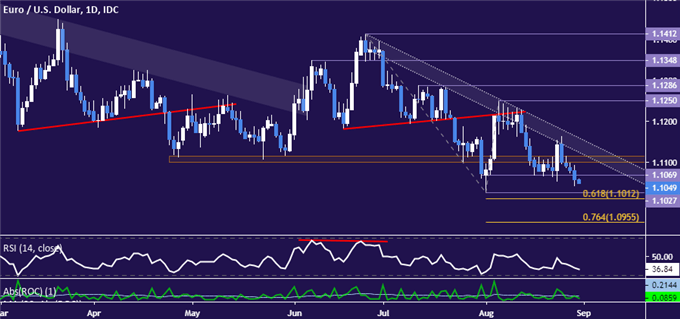

The Euro was rejected lower after yet another foray upward challenging near-term trend resistance set from the late June swing top. Prices slumped back through the 1.11 figure to issue the lowest close yet of 2019, putting the August 1 low at 1.1027 back in sellers’ crosshairs.

Support is reinforced by the 61.8% Fibonacci expansion at 1.1012. A break below that level confirmed on a daily closing basis opens the door for a test of the 76.4% Fib at 1.0955. Neutralizing immediate selling pressure would probably require a close above downtrend resistance, now at 1.1159.

Daily EURUSD chart created in TradingView

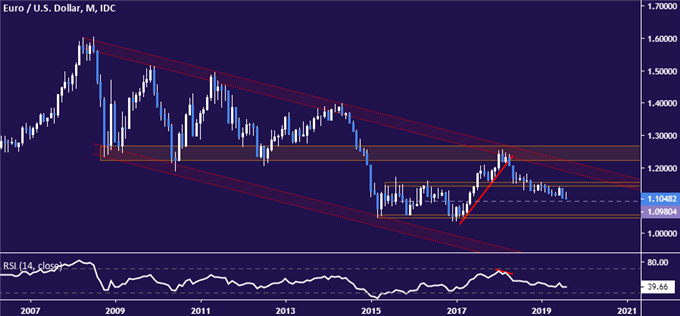

Turning to the monthly chart, prices are a critical inflection point as August draws to a close. EURUSD is poised to pressure a four-year inflection level at 1.0980. Closing the month below it may set the stage for deeper loses in September, with the next layer of support meaningfully lower in the 1.0459-1.0563 zone.

Monthly EURUSD chart created in TradingView

EUR/USD TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free webinar and have your questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter