EURUSD CHART ANALYSIS: BEARISH

- EURUSD breaks Wedge top, hinting that a bullish reversal is afoot

- 4-hour trendline support has buckled, challenging bullish narrative

- Sellers looking for confirmation on a breach of support above 1.11

See our free trading guide to help build confidence in your EURUSD trading strategy !

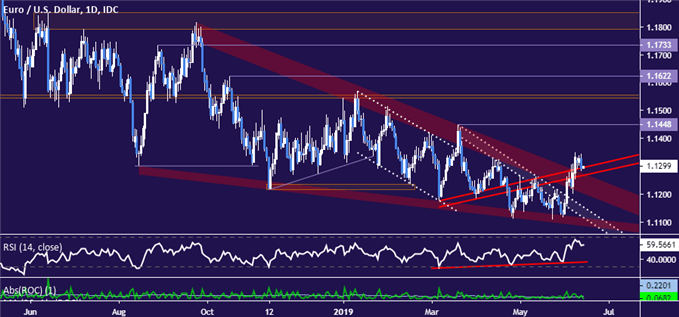

Looking at the daily chart, the Euro may be gearing up for a run higher against the US Dollar. Prices have demonstratively broken countertrend line support-turned-resistance and breached resistance at the top of a Falling Wedge chart formation in carved out since September 2018. This hints that the path of least resistance now favors the upside, at least in the near term.

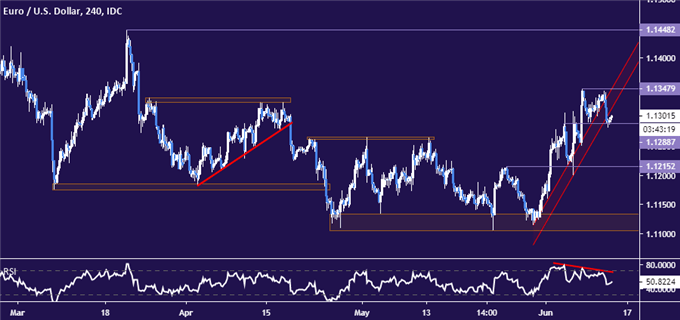

Zooming in to the four-hour chart warns that bets on bullish follow-through might be premature however. The appearance of negative RSI divergence along the way to setting recent swing highs – a sign of ebbing upward momentum – was fittingly followed by a break of trend support guiding the upswing from May lows. This evokes a corrective rise that has now given way to a prevailing downtrend.

The latest EURUSD pullback has not extended so far as to invalidate the Wedge breakout on the daily chart, cautioning against its premature dismissal. Breaking below immediate supports at 1.1289 and 1.1215 would start that process, but a daily close below support in the 1.1106-33 area – the launchpad for the recent upswing – is probably needed for sellers to regain confidence in earnest.

EURUSD TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free webinar and have your questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter