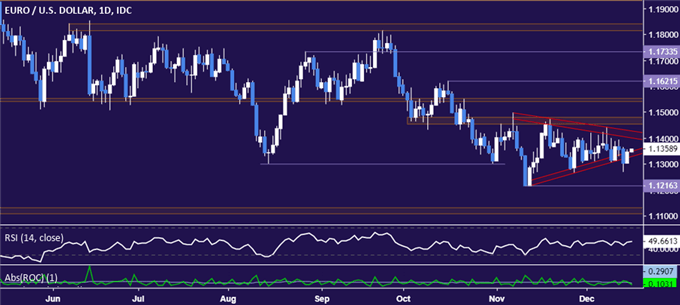

EUR/USD Technical Strategy: SHORT AT 1.1297

- Euro breaks Triangle pattern floor, hinting down trend resuming

- Short trade triggered just below 1.13, targeting November bottom

- Broadly looking for continuation of the decade-long Euro decline

Build confidence in your Euro trading strategy with our free guide!

The Euro broke downward through the bottom of a Triangle chart formation, suggesting continuation of the down trend against the US Dollar is at hand (as expected). Prices bounced to retest the pattern’s floor as resistance but fell conspicuously short of closing back above it, seemingly reinforcing the case for a meaningful breakdown that is likely to find follow-through.

Bearish resumption from here sees initial support at 1.1216, the November 12 low, with a break below that paving the way for a challenge of the support cluster in the 1.1110-32 area. The triangle floor is now at 1.1351, with a daily close above that marking a downshift in selling pressure and opening the door for another test of the pattern’s upper extremity at 1.1428.

A short EUR/USD position was triggered at 1.1297 when the break of Triangle support was witnessed on a four-hour chart last week. The trade initially targets 1.1216 but this will be given room to develop if that level is breached with the aim of capturing the next leg in the long term EUR/USD downtrend guiding the pair lower since mid-2008.

EUR/USD TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Trading Q&A webinar and have your questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter