EUR/USD Technical Strategy: NET SHORT AT 1.2276

- Euro recovery may bring retest of 1.15 figure vs US Dollar

- Upswing seen as corrective within the long term downtrend

- Signs of bullish exhaustion sought to add to short position

See our free guide to get help building confidence in your EUR/USD trading strategy !

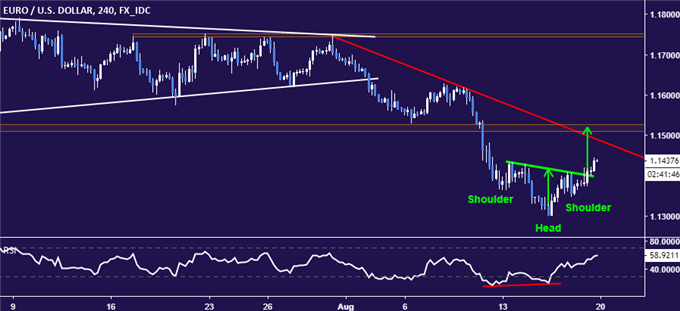

The Euro may recover further against the US Dollar having found support at the 1.13 figure before the dominant long-term down trend is resumed. The appearance of positive RSI divergence preceded a bounce as expected and a completed Head and Shoulders pattern on the four-hour chart suggests a retest above the 1.15 threshold is in the cards ahead.

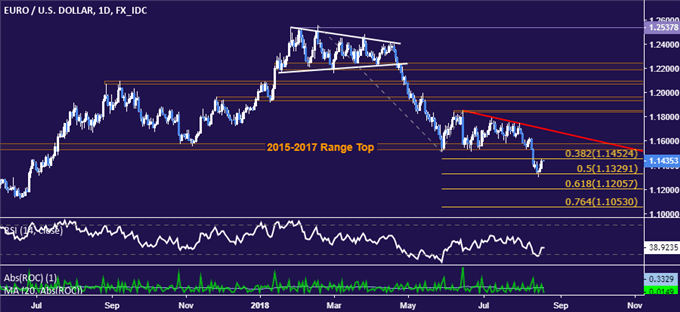

Turning to the daily chart, the broader bearish bias seems readily apparent, with price action since mid-April defined by a series of lower highs and lows. A daily close above the 38.2% Fibonacci expansion at 1.1452 opens the door for a retest of support-turned-resistance in the 1.1527-77 area. Alternatively, a push below the 50% level at 1.1329 paves the way for a challenge of the 61.8% Fib at 1.1206.

The EUR/USD short trade triggered at 1.2407 and subsequently scaled up near 1.19 continues to be in play. The developing upswing will be treated as an opportunity to add to exposure further. To that end, price action will be closely monitored for signs of exhaustion, with break of counter-trend support set from the August 15 low being one possible cue to sell.

EUR/USD TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Trading Q&A webinar and have your questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter