EUR/USD Technical Strategy: SHORT AT 1.2407

- Euro brought lower by repeatedly dovish ECB commentary

- Break below trend support would mark bearish resumption

- Profit taken on half of short trade, looking to scale back in

Find out what retail traders’ EUR/USD buy and sell decisions say about the coming price trend!

The Euro suffered at the hands of a dovish ECB, as expected. President Mario Draghi poured cold water on speculation about a near-term unwinding of QE asset purchases, saying the program will continue until officials see a “sustained adjustment” in the still “subdued” underlying inflation path. The move validated a bearish EUR/USD chart setup identified ahead of the announcement.

The single currency launched higher as on-target US CPI data eased worries about Fed rate hike acceleration, but the move conspicuously stalled at trend line resistance guiding the down move set mid-February highs. Mr Draghi then helped engineer another downward push, reiterating last week’s remarks and adding that past Euro strength could weigh on inflation down the line (again, as expected).

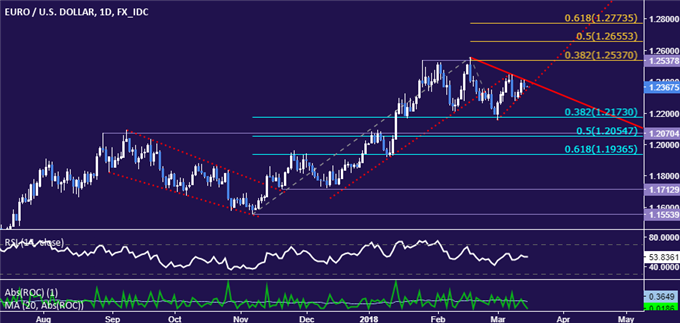

From here, a daily close below upward-sloping support established from the March swing low – now at 1.2356 – would mark down trend resumption and open the door for a test of the March 9 low at 1.2273. This is followed by major support at 1.2173, the 38.2% Fibonacci retracement. Alternatively, a push above trend line resistance at 1.2412 puts the 1.2537-8 area (double top, 38.2% Fib expansion) back in focus.

Last week’s EUR/USD short trade triggered at 1.2407 hit its initial objective at 1.2350, and which point profit was booked on half exposure. The remainder remains in play, looking to capitalize on the developing down trend. Opportunities to scale up the position will be taken to the extent that they make sense as standalone trades from a risk/reward perspective. The stop-loss will now activate on a daily close above 1.2412.

EUR/USD TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Trading Q&A webinar and have your questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter

To receive Ilya's analysis directly via email, please SIGN UP HERE