To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

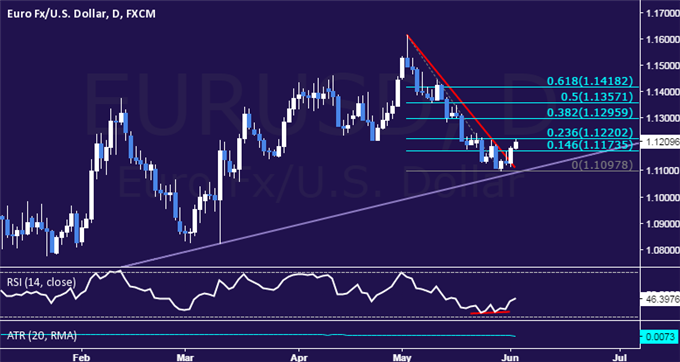

- EUR/USD Technical Strategy: Short at 1.1317

- Euro turns higher vs. US Dollar as expected but ECB may stymie progress

- Short trade still in play to capture down trend resumption after correction

The Euro is attempting to correct higher as expected, with prices taking out near-term trend line resistance guiding the decline from early-May swing highs. Upside momentum may be stymied by a dovish posture from the ECB at the upcoming monetary policy announcement however.

A daily close above the 23.6% Fibonacci retracement at 1.1220 opens the door for a challenge of the 38.2% level at 1.1296. Alternatively, a reversal below the 14.6% Fib at 1.1174 paves the way for a retest of the May 30 low at 1.1098.

Near-term gains are expected to be corrective within the context of a longer-term down trend. With that in mind, remaining exposure on a EUR/USD short trade at 1.1317 after partial profits were booked will remain in play to capture renewed downside momentum. The stop-loss has been adjusted to breakeven.

Is Euro price action matching DailyFX analysts’ 2016 outlook? Find out here !