To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

- EUR/USD Technical Strategy: Flat

- Euro Declines After Forming Bearish Candlestick Pattern, Targets Support Below 1.13

- Passing on Short Position Until Risk/Reward Parameters Evolve to Favorable Setting

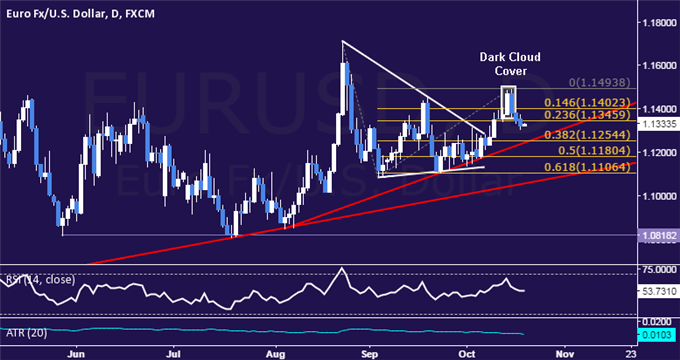

The Euro moved downward against the US Dollar as expected after prices put in a bearish Dark Cloud Cover candlestick pattern. Sellers now aim to challenge support below the 1.13 figure, with a breach putting the fate of the upswing from mid-March in play.

A daily close below 1.1254, the intersection of the 38.2% Fibonacci expansion and a rising trend line set from early August, opens the door for a test of the 50% level at 1.1180. Alternatively, a reversal above the 23.6% Fib at 1.1346 clears the way for a challenge of the 14.6% expansion at 1.1402.

While it is tempting to take up a short position in line with the long-term trend and broad-based fundamental considerations, we will tactically stand aside. The available trading range is narrower than 20-day ATR, tilting risk/reward parameters against triggering a trade. With that in mind, we remain flat until something more compelling presents itself.

Losing Money Trading Forex? This Might Be Why.