To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

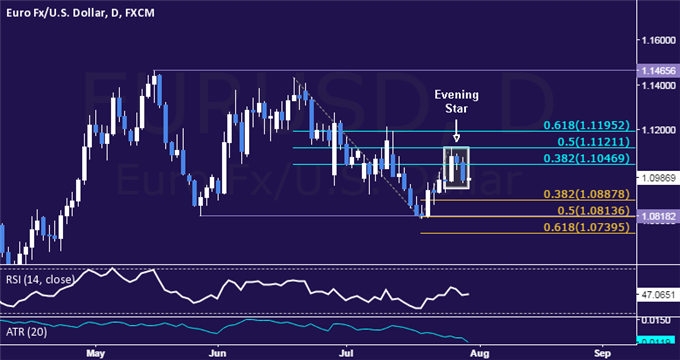

- EUR/USD Technical Strategy: Flat

- Support: 1.0888, 1.0814, 1.0740

- Resistance:1.1047, 1.1121, 1.1195

The Euro put in a bearish Evening Star candlestick pattern, hinting the down trend against the US Dollar may be resuming. Near-term support is at 1.0888, the 38.2% Fibonacci expansion, with a break below that on a daily closing basis exposing the 1.0814-18 area (50% level, May 27 low). Alternatively, a turn above the 38.2% Fib retracement at 1.1047 clears the way for a test of the 50% threshold at 1.1121.

While it is tempting to enter short in line with our long-term outlook, prices are too close to support to justify pulling the trigger at market from a risk/reward perspective. Instead, we will establish a pending order to sell the pair at 1.1008. If triggered, the trade will initially target 1.0888.

Add these technical levels directly to your charts with our Support/Resistance Wizard app!

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com