EUR/JPY Price Outlook

Have you checked our latest trading guides for USD and Gold? Download for free Q3 Main Currencies and Commodities Forecasts

EUR/JPY– Buyers Failed Attempt

On July 8, EUR/JPY opened with an upward gap then rallied on Wednesday to its highest level in a week, however the pair slipped back below 122.00 handle and closed with a bearish Doji pattern, signaling the weakness of the buyers to keep rallying the price.

Alongside, the Relative Strength Index (RSI) pointed higher, although; failed to cross above 50 indicating the buyer’s lack of momentum to kick start uptrend move.

Having trouble with your trading strategy? Here’s the #1 Mistake That Traders Make

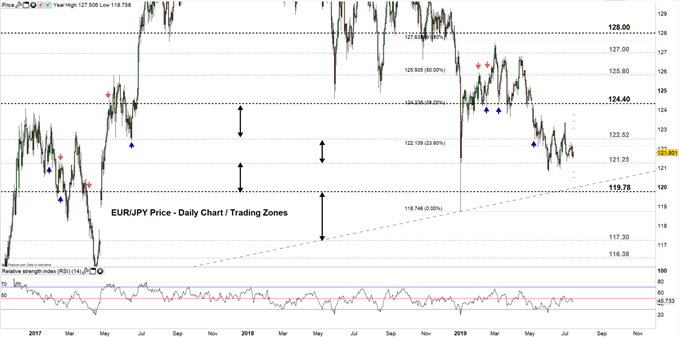

EUR/JPY DAILY PRICE CHART (DEC 1 , 2016 – JUl 15, 2019) Zoomed OUT

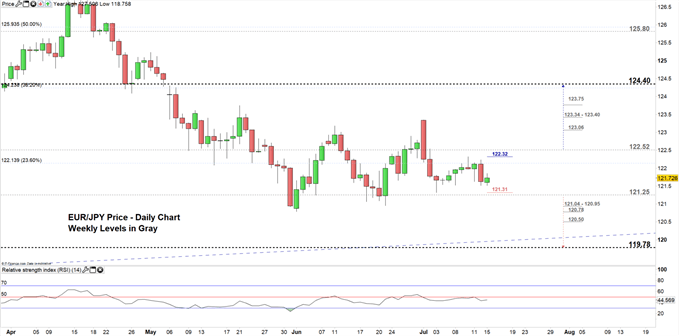

EUR/JPY DAILY PRICE CHART (April 7, 2019- JUL 15, 2019) Zoomed IN

Looking at the daily chart we notice at the start of July, EUR/JPY stuck in tight trading zone 122.52- 121.25, and since July 3 the pair failed to test any of the high or the low end of this zone.

Thus, a close below the low end of the aforementioned trading zone may press the price towards 119.78, although the weekly support zone and levels marked on the chart (zoomed in) need to be watched along the way.

In turn, a close above the high end of the trading zone could cause the price to rally towards 124.40, however, the weekly resistance zone and levels underlined on the chart (zoomed in) would be worth monitoring.

Just getting started? See our Beginners’ Guide for FX traders

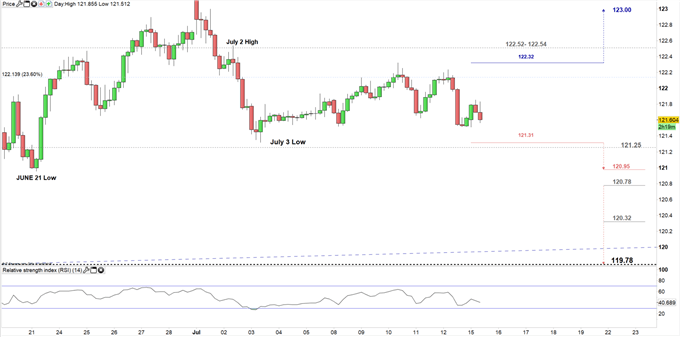

EUR/JPY Four-HOUR PRICE CHART (June 20, 2019 – JUL 15, 2019)

Looking at the four-hour chart we notice on July 3, EUR/JPY rebounded from 121.31 (weekly low) therefore, a break below this threshold would lead the price to print its lowest level in nearly four weeks and could send the price towards the June 21 low at 120.95, contingent on clearing the weekly support at 121.25. See the chart to know more about the next significant support if the selloff continues below mentioned levels.

On the other hand, we notice on July 5, EUR/JPY started a short uptrend creating higher highs with higher lows, however this uptrend stalled on July 10 at 122.32 (weekly high) hence, a break above this high might activate this uptrend and could send the price towards 123.00, however; the vicinity at 122.52-54 should be kept in focus.

Written By: Mahmoud Alkudsi

Please feel free to contact me on Twitter: @Malkudsi