Talking Points:

- EUR/JPY continued to fall through last week’s ECB rate decision, finally finding a bit of support around the 129.00-handle. Prices have rallied back towards an area of prior support that runs from 130.00 to 130.35, and the next 24 hours bring two critical drivers with the Bank of Japan rate decision scheduled for tonight followed by the release of Euro-Zone inflation figures tomorrow morning.

- EUR/JPY started Q3 on a bright note, showing the same strength that defined the pair’s price action for the final eight months of 2017. But the first half of 2018 wasn’t so kind, as an aggressive pullback ran from February into the end of May. The big question at this point is which trend takes over for the second half of 2018? Are we going to see Yen-weakness in the driver’s seat as the BoJ remains one of the loosest Central Banks in the land: Or are we going to see Euro weakness take-over as investors continue to price out ECB rate hikes towards the end of 2019?

- DailyFX Forecasts on a variety of currencies such as the US Dollar or the Euro are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.

Do you want to see how retail traders are currently trading the Euro or the Japanese Yen? Check out our IG Client Sentiment Indicator.

EUR/JPY: Two Pertinent Drivers On the Economic Calendar

EUR/JPY extended its sell-off last week after a European Central bank rate decision that didn’t bring much by way of new information. That bearish move helped to bring to question the previous bullish trend that had started to show in the final weeks of Q2, and ran fairly-well into the first couple of weeks of Q3. As we trade into this week, and especially over the next 24 hours, this theme will be in full-focus as we have a Bank of Japan rate decision later tonight followed by the release of Euro-Zone inflation numbers set for tomorrow morning. The potential for volatility in the pair is very high with these drivers looming on the economic calendar.

DailyFX Economic Calendar: Euro-Zone Data Set to be Released Shortly After BoJ Rate Decision

Chart prepared by James Stanley

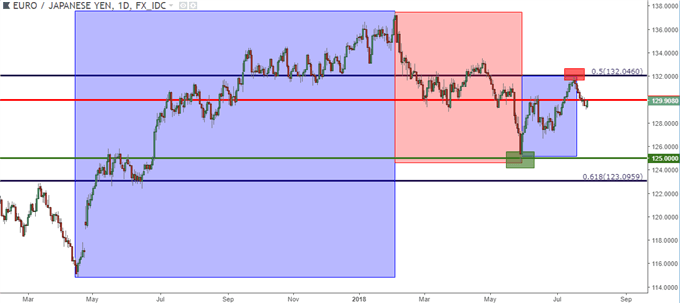

The bearish move that showed in EUR/JPY in the first half of this year brought to question the bullish uptrend that showed so prominently in 2017. Prices topped-out in early-February and continued to sell-off into late-May (shown in the red box on the below chart). Support finally showed around the 125.00 psychological level as we traded into June, and prices continued to trend-higher into mid-July, eventually finding a bit of resistance just shy of the 132.00-handle.

EUR/JPY Daily Price Chart

Chart prepared by James Stanley

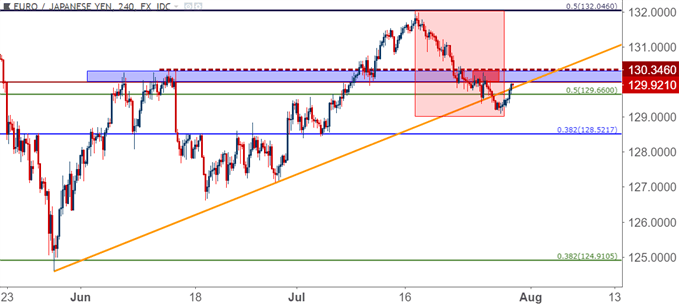

Last week, we looked at price action in the pair ahead of the ECB rate decision on Thursday. As we examined, that theme of Q3 strength in EUR/JPY was reversed mid-month in EUR/JPY. This was driven by a couple of different factors, key of which was a reversal of Yen-weakness as questions started to percolate around the upcoming BoJ rate decision, and whether or not the bank may make the initial alteration towards tapering their QE outlay. At the time, prices had just started to test a bullish trend-line that can be found by connecting the May and June 27th swing lows. This helped prices to pose a short-term bounce up to find resistance at prior support in an area that runs from 130.00 to 130.35. Sellers took over shortly thereafter, and drove prices down to a fresh three-week-low.

EUR/JPY Four-Hour Price Chart

Chart prepared by James Stanley

EUR/JPY Technical Strategy

At this point, near-term trend remains unclear and we have both bullish and bearish potential as we approach two really large drivers on the calendar that are highly-pertinent to the pair. If we do see a resistance check within the zone that runs from 130.00-130.35, the door could re-open for bearish strategies, targeting a return back towards 128.52; but traders would likely want to confirm that resistance is in-fact holding, as can be shown from a wick atop price action on the daily bar of Tuesday’s candle.

If we do see a bullish break beyond this area of resistance, topside strategies could soon become attractive again under the scenario of Yen-weakness taking over, as we saw earlier in Q3. At that point, traders would likely want to avoid chasing the topside move; instead letting price settle to a higher-low before looking to implement bullish strategies that could remain workable for the foreseeable future as Yen-weakness becomes a prominent theme again.

To read more:

Are you looking for longer-term analysis on the U.S. Dollar? Our DailyFX Forecasts for Q1 have a section for each major currency, and we also offer a plethora of resources on USD-pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our IG Client Sentiment Indicator.

Forex Trading Resources

DailyFX offers a plethora of tools, indicators and resources to help traders. For those looking for trading ideas, our IG Client Sentiment shows the positioning of retail traders with actual live trades and positions. Our trading guides bring our DailyFX Quarterly Forecasts and our Top Trading Opportunities; and our real-time news feed has intra-day interactions from the DailyFX team. And if you’re looking for real-time analysis, our DailyFX Webinars offer numerous sessions each week in which you can see how and why we’re looking at what we’re looking at.

If you’re looking for educational information, our New to FX guide is there to help new(er) traders while our Traits of Successful Traders research is built to help sharpen the skill set by focusing on risk and trade management.

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX