To receive James Stanley’s Analysis directly via email, please sign up here.

Talking Points:

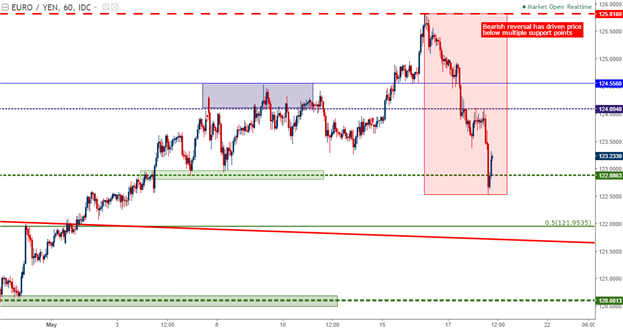

- EUR/JPY Technical Strategy: Intermediate-term: mixed, short-term: bearish.

- EUR/JPY has started an aggressive reversal of the prior bullish move as the Japanese Yen has turned-around.

- If you’re looking for trading ideas, check out our Trading Guides. If you’re looking for shorter-term ideas, check out our IG Client Sentiment.

In our last article, we looked at EUR/JPY showing some indication of ‘topping’ despite its aggressively bullish price action. While the bullish move was developing, there was very little pullback and very mild retracements that made jumping-on the long side a bit of a challenge. But after the pair ‘topped out’, prices have put in a peak-to-trough movement of over 300 pips as bears began to take control.

Chart prepared by James Stanley

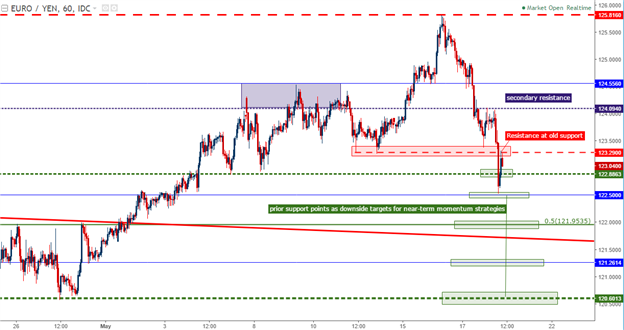

For short-term perspectives, this near-term bearish momentum could be hard to ignore, and traders can look to trade bearish trend continuation on shorter time frames, inside of the 4-hour chart, by targeting prior levels of support for the continuation of the down-side move. Such support levels exist at 122.88, 122.50, 121.95, 121.25 and 120.60.

Chart prepared by James Stanley

For intermediate-term and longer-term stances, traders will likely want to wait before pressing the bearish side of the trade, as this move is still very young, and finding an amenable area to manage risk for bigger-picture bearish strategies could be a challenge.

As we had discussed in our last article, the topside move in EUR/JPY had gotten extremely overbought. And while the past two days of bearish price action has seen an aggressive move develop, longer-term, EUR/JPY is still bullish in nature, as we have yet to interact with the 38.2% retracement of the recent bullish move.

This exposes two support areas that could be utilized in the effort of catching support for a bullish swing. Important here is actually waiting for support to develop, as indicated by wicks on the under-side of candles at or around the level itself. The nearer of the two zones is from 121.62-121.95, and the deeper zone straddles the 120.00 psychological level with 119.91-120.32.

Chart prepared by James Stanley

--- Written by James Stanley, Strategist for DailyFX.com

To receive James Stanley’s analysis directly via email, please SIGN UP HERE

Contact and follow James on Twitter: @JStanleyFX