To receive James Stanley’s Analysis directly via email, please sign up here.

Talking Points:

- EUR/JPY Technical Strategy: Near-term trend with bullish prospects.

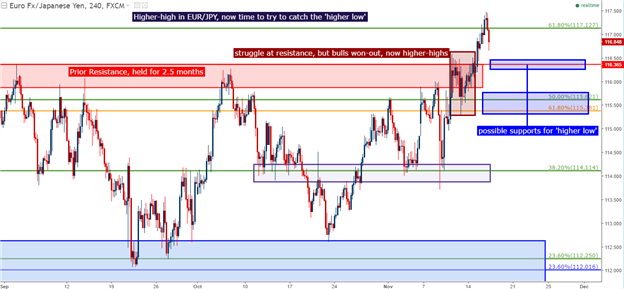

- EUR/JPY printed a higher-high yesterday, breaking a batch of resistance that held for over two months, and this opens the door for bullish continuation in the pair.

- If you’re looking for trading ideas, check out our Trading Guides.

In our last article, we looked at a batch of resistance sitting just above price action at the time. Fresh on the heels of the U.S. Presidential Election, EUR/JPY put in a quick-break of support at the 114.11 level before reversing aggressively and running up to resistance. But given the fact that surging prices had been twice-rebuked at this zone of resistance over the past 2 ½ months, traders would likely want to wait for further confirmation of bullishness before looking to add exposure.

The level that we’ve been watching for that bullish indication was at 117.13. This is the 61.8% Fibonacci retracement of the ‘Brexit move’ in the pair, and this same Fibonacci retracement’s 38.2% level had helped to carve out prior support at 114.11. With prices moving up to, and catching resistance off of this higher-high, the door opens for bullish continuation setups; and at this point, traders can look for the ‘higher-low’ in the effort buying support in an up-trend.

On the chart below, we’re looking at two potential areas to begin watching for that next ‘higher low’ to print. The prior batch of resistance can be an opportune level for such an observation, but given the amount of ‘whipsaw’ that was seen around resistance, a further break lower may be in store and the zone between 115-115.62 could also be an attractive zone for ‘higher-low’ support to develop.

Should price action break below 115, traders will likely want to question the prospect of bullish continuation, and should the election swing-low at 113.70 become broken, the bullish bias can be abandoned altogether, at least for now.

Chart prepared by James Stanley

--- Written by James Stanley, Analyst for DailyFX.com

To receive James Stanley’s analysis directly via email, please SIGN UP HERE

Contact and follow James on Twitter: @JStanleyFX