To receive James Stanley’s Analysis directly via email, please sign up here.

Talking Points:

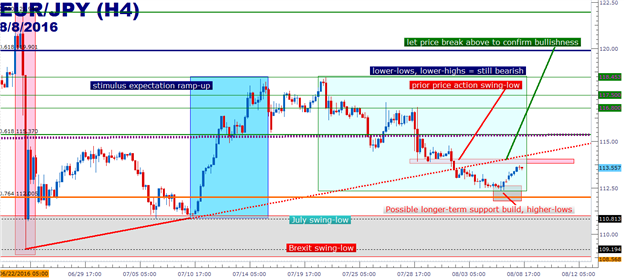

- EUR/JPY Technical Strategy: Big-picture down-trend working on higher-lows, very near longer-term base of support.

- EUR/JPY is up over 100-pips off of last week’s lows and fast approaching prior price action support. Should price action break above this zone + a projected trend-line, top-side strategies could become attractive.

- If you’re looking for trading ideas, check out our Trading Guides. And if you want something more short-term in nature, check out our SSI indicator.

In our last article, we looked at the breakdown in EUR/JPY on the heels of a BoJ rate decision that left many market participants wanting for more. While expectations for enhanced stimulus out of Japan were running extremely high going into the most recent BoJ decision, the bank largely underwhelmed and this created a sharp move of Yen strength as stimulus bets priced-out of Japanese markets. But have we heard the last from the Bank of Japan? Probably not, and more likely, other market participants are harboring the expectation for the BoJ to come to the table with something ‘big’ before the end of the year.

None-the-less, price action in EUR/JPY at this point remains bearish as denoted by a recent series of lower-lows and lower-highs that have come-in post-BoJ. We do have the initial makings of what could be a top-side reversal, as prices have moved more than 100 pips off the lows into an interesting area of potential resistance. Just a few pips above current levels is prior price action swing support at 113.88, and just a few pips above that we have a projected trend-line that can be found by connecting the Brexit low at 109.19 to the July swing low at 110.81. Should price action break above this zone of potential resistance, then traders may be able to look at the long-side of the pair under the premise of trading bullish continuation.

Traders looking to get long would likely want to wait for price action to break above this area of potential resistance in order to confirm top-side sustainability before looking to trigger the position. Should price action break above this area around 113.88, top-side targets could seek out an initial level of 115.37, which is the 61.8% Fibonacci retracement of the ‘Abenomics move,’ taking the low in 2012 to the high in 2014. This level had also seen quite a few swings around the erratic price action during the post-Brexit environment; and above that we have a prior price action zone of resistance around 116.80, followed by the psychological level at 117.50 and then the July high at 118.45.

Alternatively, the short-side of the pair could be attractive for short-term momentum strategies until this zone of resistance at 113.88 becomes broken; but traders utilizing longer-term approaches would likely want to tread cautiously around the prospect of bearish continuation while near the well-established zone of support around the 110-big figure.

Charts prepared by James Stanley

--- Written by James Stanley, Analyst for DailyFX.com

To receive James Stanley’s analysis directly via email, please SIGN UP HERE

Contact and follow James on Twitter: @JStanleyFX