To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

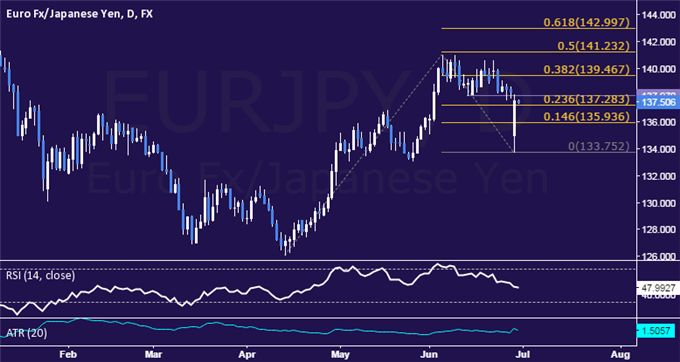

- EUR/JPY Technical Strategy: Flat

- Support: 137.28, 135.94, 133.75

- Resistance:139.47, 141.23, 143.00

The Euro gapped sharply lower against the Japanese Yen but failed to hold onto losses, reversing sharply higher to finish the day relatively little-changed. Near-term support is at 137.28, the 23.6% Fibonacci expansion, with a break below that on a daily closing basis exposing the 14.6% level at 135.94. Alternatively, a move above the 38.2% Fib at 139.47 opens the door for a challenge of the 50% expansion at 141.23.

Positioning is inconclusive at this point, with prices offering no clear-cut and actionable signal to initiate a long or short trade. We will continue to remain on the sidelines for the time being, waiting for a compelling opportunity to present itself.

Add these technical levels directly to your charts with our Support/Resistance Wizard app!

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com