Euro Outlook, EUR/GBP, Brexit – TALKING POINTS

- EUR/GBP plunged after headlines read that Brexit impasse on path to resolution

- Pair broke through two key support barriers and is now back in congestive range

- Traders are anxiously waiting for more news as key EU-UK summit draws closer

Learn how to use political-risk analysis in your trading strategy !

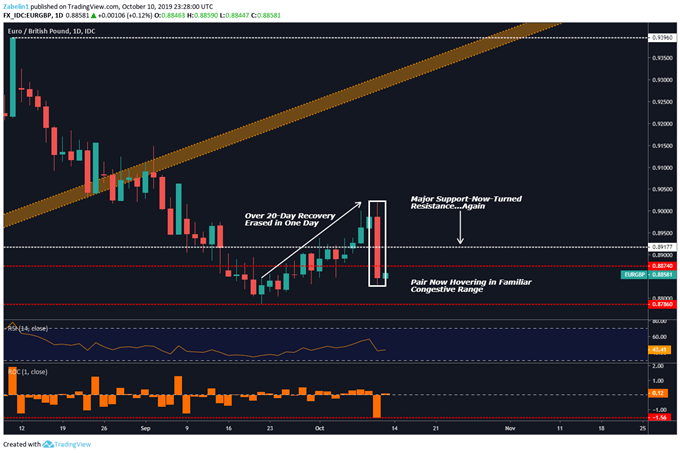

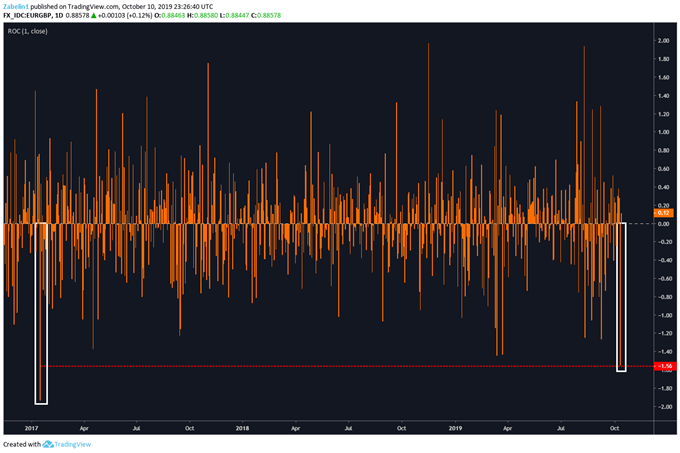

EUR/GBP plunged over 1.5 percent on October 10, the biggest one-day move since January 2017. On the way down, the pair broke through two major support levels, one of which the pair had been aiming to break above after rebounding from the 5-month low at 0.8786.

EUR/GBP – Daily Chart

EUR/GBP chart created using TradingView

Rate of Change Indicator (One Day Time Frame) Shows Biggest Fall in Two-Year Period

EUR/GBP chart created using TradingView

As I had said in my weekly forecast a few months ago:

"Performing technical analysis on a pair whose counter currency is linked to a fundamentally volatile environment makes it unusually difficult and unpredictable. There is no telling when a sudden political development will cross the headlines and what the respective magnitude of the price swing will be"

The very forces that caused EUR/GBP to plunge are fickle and are therefore capable of reversing losses in the pair in a relatively short span of time. In the short run, the pair may break past 0.8874 and aim to re-test 0.8917 after just having broken above it this week.

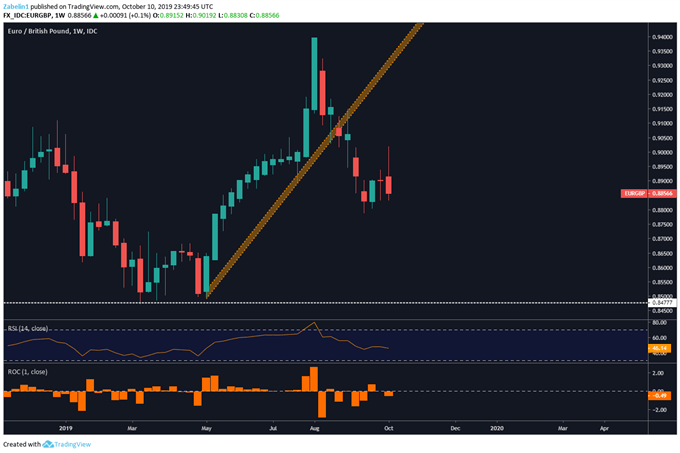

Zooming out to a weekly chart shows the pair was in free-fall after breaking below critical rising support but appears now to be gently reversing its descent. However, the pair’s recovery may be interrupted by sporadic Brexit-related developments that may either accelerate the cautious uptrend or derail it.

EUR/GBP – Weekly Chart

EUR/GBP chart created using TradingView

EUR/GBP TRADING RESOURCES

- Join a free webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter