EUR/GBP Technical Analysis

- Declines in EUR/GBP accelerated as expected

- Defining trend still absent given consolidation

- Technical and sentiment signals still tilt bearish

Just started trading EUR/GBP? Check out our beginners’ FX markets guide !

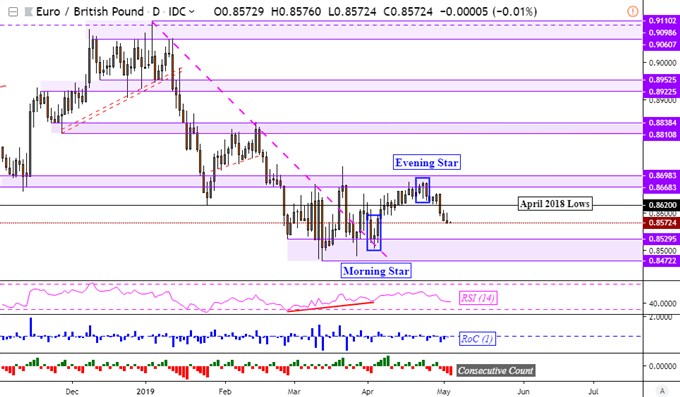

The British Pound appreciated against the Euro, adding to gains since I pointed out bearish technical and sentiment signals in EUR/GBP. One of these is an Evening Star candlestick formation which formed under near-term resistance at 0.8698 on the chart below.

Yet, the pair is still far from achieving a trend in the bigger picture, though EUR/GBP’s recent progress certainly put it in the right direction. This is because the dominant downtrend since January is still on hold as prices consolidate between resistance and support with the latter being above 0.8472.

Achieving a breakout in either direction should come with fundamental support, but that seems unclear for now. This is because the uncertainties of Brexit dampen the impact of monetary policy to a certain extent. An example of this is how the British Pound failed to find much support on a hawkish bias from the BoE.

Turning our attention back to technical analysis, it seems that the floor of consolidation is on the menu ahead given the bearish signals. You may follow me on Twitter here @ddubrovskyFX as I closely watch the pair’s performance for signs that its range-bound trade may end.

EUR/GBP Daily Chart

Chart Created in TradingView

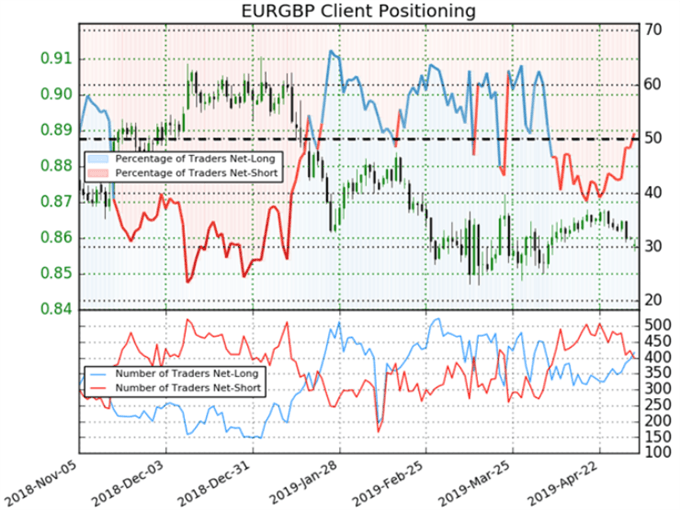

EUR/GBP Bearish Sentiment Bias

Last week, sentiment readings warned of a bearish contrarian trading bias. Prices have since fallen about 0.65% as traders are further net-long than yesterday and last week. As such, the bearish signal still persists on the chart below. If you are interested in this, join me every week on Wednesday’s at 00:00 GMT as I uncover what positioning has to say about prevailing market trends !

FX Trading Resources

- Join a free Q&A webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- See our free guide to learn what are the long-term forces Euro prices

- See how the British Pound and Euroare viewed by the trading community at the DailyFX Sentiment Page

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter