EUR/GBP Technical Strategy: Flat

- Euro attempting to revive its uptrend against the British Pound

- Congested near-term positioning doesn’t offer clear trade setup

- Chart bias points higher but Turkey risk argues against longs

See our free guide to help build confidence in your EUR/GBP trading strategy !

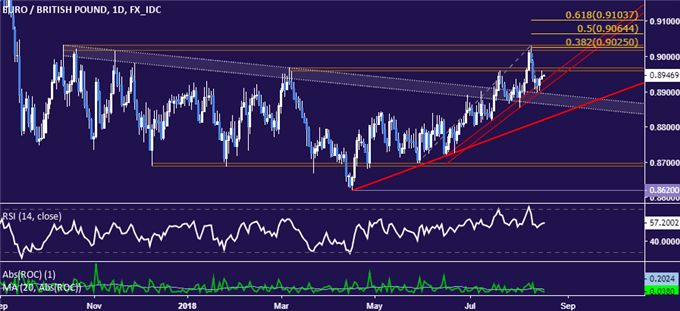

The Euro is attempting to revive its four-month uptrend against the British Pound after recoiling from chart resistance above the 0.90 figure. Prices now sit squarely at the confluence of the rising trend floor set from mid-June and a former upside barrier guiding the down move from October 2017, now recast as support.

From here, a daily close above the 0.8960-68 area opens the door for a challenge of the 0.9017-33 zone, marked by a long-standing range top and the 38.2% Fibonacci expansion. Alternatively, a break below the lowest layer of current support – now at 0.8864 – exposes a rising trend line at 0.8822.

Current positioning looks too congested to extract a viable trading opportunity with acceptable risk/reward parameters. Furthermore, a clash between technical poisoning and the fundamental backdrop complicates trade selection. The immediate trend favors the upside but on-going worries about the spillover of Turkey’s troubles into the Eurozone warn against taking up the long side. In all, staying flat seems sensible.

EUR/GBP TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter