To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

- EUR/GBP Technical Strategy: Flat

- Euro struggling to build momentum, stalling at range floor

- Looking for actionable setup, bearish trend bias favored

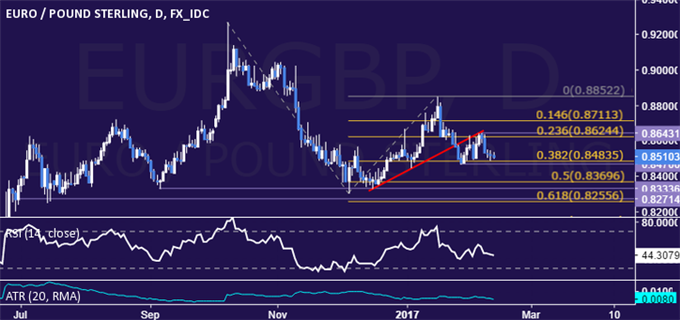

The Euro is struggling to build downside momentum after seemingly resuming its longer-term bearish trend against the British Pound in late January. Prices are mired in a choppy range below the 0.87 figure and seemingly waiting for a potent-enough catalyst to rekindle momentum.

Near-term support is in the 0.8470-84 area (January 26 low, 38.2% Fibonacci expansion), with a break below that on a daily closing basis opening the door for a test of the 0.8334-70 zone (double bottom, 50% level). Alternatively, a break above the February 6 high at 0.8643 exposes the 14.6% Fib at 0.8711.

On one hand, prices are too close to support to justify entering short from a risk/reward perspective. On the other, the absence of an actionable bullish signal and broadly bearish longer-term positioning argue against taking up the long side. Staying on the sidelines seems most prudent.

What makes EUR/GBP one of the top DailyFX trades for 2017? See our forecast and find out!