To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

- EUR/GBP Technical Strategy: Flat

- Trend Line Beak Hints at Larger Euro Recovery vs. British Pound Looming Ahead

- Aiming to Enter Short in Line with Long-Term Trend After Upward Retracement

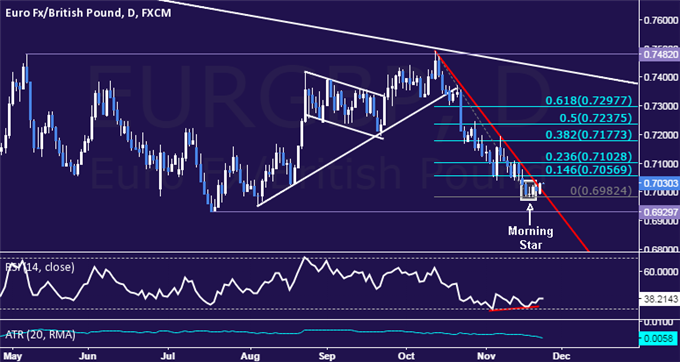

The Euro may have carved out a near-term bottom against the British Pound as expected after breaking above falling trend resistance set from mid-October. Prices produced a bullish Morning Star candlestick coupled with positive RSI divergence, pointing the pair was set to turn higher after finding support below the 0.70 figure.

Near-term resistance is at 0.7057, the 14.6% Fibonacci retracement, with a break above that on a daily closing basis clearing the way for a challenge of the 23.6% level at 0.7103. Alternatively, a reversal below the November 18 low at 0.6982 opens the door for a test of the July 17 bottom at 0.6930.

From a long-term perspective, the overall EUR/GBP trend appears to continue favoring the downside. As such, we will treat on-coming gains as a retracement offering a selling opportunity within the larger descent. In the meantime, we will remain flat.

Losing Money Trading Forex? This Might Be Why.