Talking Points:

- Difficult to find any tradable scenarios at the moment due to the EU Referendum

- Significant implications for the global financial markets might see the ASX volatile as well

- A very long term outlook might be necessary as UK polls open

Volatility is set to be high with the Brexit vote. Learn good trading habits with the “Traits of Successful Traders” series

The ASX 200 currently trades below the 5,300 short term resistance, which appears to have capped gains in the last three trading days.

Price movements are expected to dramatically shift in the hours and days ahead, as we rapidly approach a resolution to the so called “Brexit” referendum, which could potentially have game-changing implications for the global financial markets as a whole.

Indeed, it appears difficult to find reasonable risk-reward trading scenarios at the moment due to the uncertainty and expected volatility, which in turn might imply that a very long term view is required for the hours and days ahead, as short term technical levels seem unlikely to have any significance. Taking this into consideration, we turn our attention to the Monthly chart.

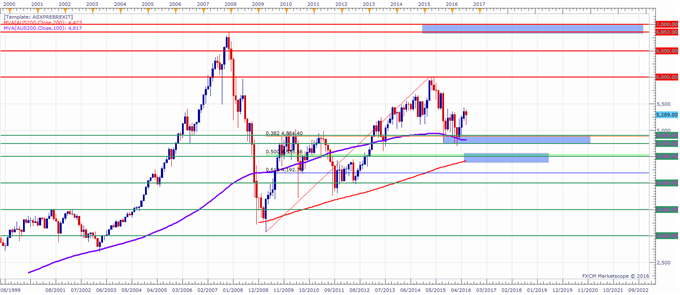

ASX 200 Monthly Chart: June 23, 2016

The long term up trend from 2009 is in focus looking at the chart above. The Fib drawn from the March 2009 low at 3,073 to the April 2015 high at 6,020 reveals possible interesting levels on a move lower.

The first area of interest to buyers might be a confluence of resistance levels below the 4,900 figure, which coincides with the 0.382 Fib, the 100 SMA and prior support at 4,750 that could create a possible support zone.

The 0.50 Fib below coincides with the 4,500 round number, while the 0.618 Fib sits close to the 4,200 level. The big 4,000 figure is just below, and has acted as support in the past.

Levels of interest on a move higher might initially be the 2015 highs around the 6,000 handle, followed by the 6,500 round figure and a possible resistance zone above the 2007 highs at 6,852 to the 7,000 handle.

--- Written by Oded Shimoni, Junior Currency Analyst for DailyFX.com

To contact Oded Shimoni, e-mail instructor@dailyfx.com