December RBA Meeting Overview:

- The Reserve Bank of Australia meets on Tuesday, December 1 at 3:30 GMT; rates markets are pricing in a 75% chance of the main rate staying on hold.

- AUD/USD rates remain in their sideways range, but are hovering near resistance and soon may attempt a bullish breakout.

- Retail traders are less net-short AUD/USD rates than yesterday and compared with last week.

12/01 TUESDAY | 03:30 GMT | AUD RESERVE BANK OF AUSTRALIA RATE DECISION

Since the last Reserve Bank of Australia rate decision on November 3, there are signs that the Australian economy has made more positive strides, outperforming both the central bank’s as well as economists’ expectations. The Citi Economic Surprise Index for Australia, a gauge of economic data momentum, gained from +86.9 on November 3 to +156.3 by Monday, November 30.

A slew of better than expected reports, including October Australian employment data and November Australian PMIs, have suggested that the economy is gaining steam headed into the end of the year. To this end, rates markets are suggesting the RBA will keep its main rate on hold at 0.1% when it meets for the final time in 2020.

Recap: Reserve Bank of Australia Changed Mandate at November Meeting

As expected, the RBA’s November policy meeting yielded a 15-bps rate cut bringing the main rate to 0.10%, but the more noteworthy development (at least one that wasn’t discounted by markets yet) was the shift in focus for policymakers. RBA Governor Philip Lowe said that “Labour markets are working differently than they used to and wage and inflation dynamics have changed…given this, we have now moved to place much more weight on actual outcomes, rather than forecast outcomes, in our decision making and our forward guidance.”

From my understanding, this means there will be a greater focus on actual labor market outcomes (e.g. the unemployment rate) over expected price pressures. The RBA itself has conceded that the housing market and labor market remain more robust than anticipated earlier this year, suggesting that any more extraordinary easing efforts may not come via the interest rate channel.

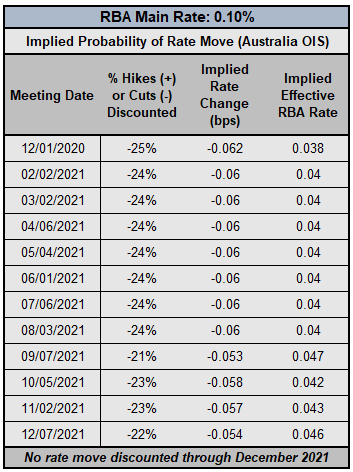

RESERVE BANK OF AUSTRALIA INTEREST RATE EXPECTATIONS (NOVEMBER 20, 2020) (TABLE 2)

According to Australia overnight index swaps, there is between a 22 to 25% chance of a rate cut through December 2021, which appears to be nothing more than a pricing quirk due to the RBA’s extraordinary efforts to institute yield curve control. The RBA will be keeping its overnight cash rate at 0.1% or lower for at least the next two and a half years. The December RBA meeting should be a non-event that does little to interfere with a bullish technical environment for AUD/USD rates.

Pair to Watch: AUD/USD

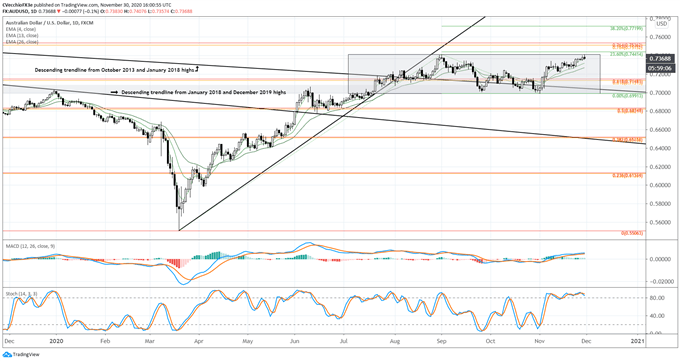

AUD/USD RATE TECHNICAL ANALYSIS: DAILY CHART (NOVEMBER 2019 to NOVEMBER 2020) (CHART 1)

AUD/USD rates remain in their sideways range, but are hovering near resistance and soon may attempt a bullish breakout, having maintained their elevation above the descending trendline from the October 2013 and January 2018 highs. A simple doubling of the range, which at 422-pips, would suggest a target of 0.7836.

Ahead of range resistance near 0.7414, bullish momentum remains strong. AUD/USD rates are still above the daily 5-, 8-, 13-, and 21-EMA, which is in bullish sequential order. Daily MACD is trending higher in bullish territory, and Slow Stochastics are holding in overbought territory.

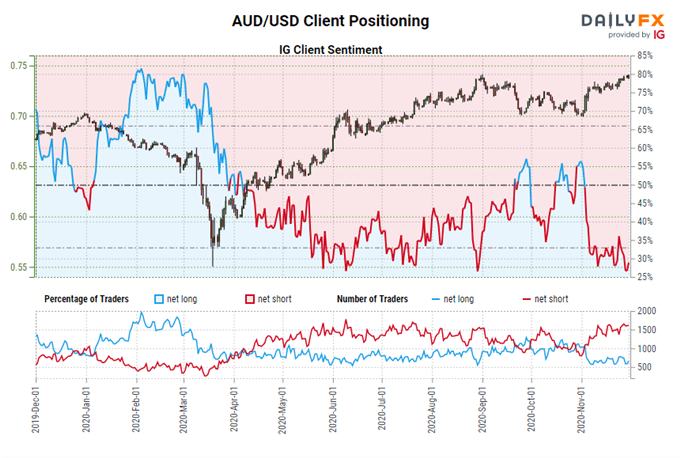

IG Client Sentiment Index: AUD/USD RATE Forecast (November 30, 2020) (Chart 2)

AUD/USD: Retail trader data shows 30.81% of traders are net-long with the ratio of traders short to long at 2.25 to 1. The number of traders net-long is 28.77% higher than yesterday and 6.06% higher from last week, while the number of traders net-short is 5.36% higher than yesterday and 3.37% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests AUD/USD prices may continue to rise.

Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current AUD/USD price trend may soon reverse lower despite the fact traders remain net-short.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist