AUD/USD Highlights:

- AUD/USD holding above the 7000-line

- Wedge pattern soon to determine direction

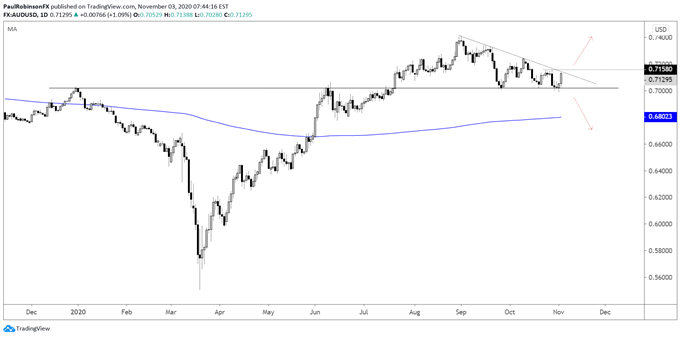

AUD/USD is in the process of carving out a descending wedge above a big level of support, a development that we discussed last week. But with price getting ever closer to the apex of the pattern we should soon have a resolution that leads to a sustainable move.

After a very minor breach of support around 7000, we have seen some life come back into Aussie, enough so that we are seeing price now pressing up against the upper trend-line of the descending wedge. A wedge that is running out of time before a breakout occurs…

A couple of days ago it looked very much like the break was going to come on the downside, and right now it looks like the break is going to come to the upside. This is why it is very important when trading any type of pattern, that we wait for a confirmed breakout before running with an aggressive bias, and not try and anticipate.

The ‘easier’ path still looks like a downside break, because of the lower highs (indicating a willingness for the market to sell sequentially lower), and more importantly because the 7000-line has become increasingly more important as a meaningful support level. A daily close below would likely trigger some degree of selling.

The top-side could still be the path of least resistance, but we will need to see a break of the trend-line running down off the Sep 1 high. A close above the trend-line and 7158, a small near-term swing-high, could do it terms of setting off a rally.

What we will want to be on the look-out for is fake-outs, those breaks in either direction that are quickly erased and brought back under or above the breakout level in question. These patterns can lead to a false breakout then followed by a sustained breakout in the opposite direction. This is where risk management (stops) come into play and the ability to be flexible. Another way to approach these patterns is to wait for a confirmed break and run followed by a pullback for entry.

AUD/USD Daily Chart (descending wedge on verge of breaking)

Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX