Australian Dollar Technical Price Outlook: AUD/USD Weekly Trade Levels

- Australian Dollar technical trade level update - Weekly Chart

- AUD/USD price in consolidation below key resistance at– 2019 /2020 yearly opens

- Aussie constructive while above 6660- Resistance at 7042 & 7120

The Australian Dollar rallied more than 1% against the US Dollar this week with AUD/USD trading at 6930 in early New York trade on Thursday. The advance keeps Aussie within the confines of a multi-week consolidation formation and keeps the focus on a near-term breakout as we head deeper into July trade. These are the updated targets and invalidation levels that matter on the AUD/USD weekly price chart. Review my latest Weekly Strategy Webinar for an in-depth breakdown of this Aussie trade setup and more.

Australian Dollar Price Chart – AUD/USD Weekly

Chart Prepared by Michael Boutros, Technical Strategist; AUD/USD on Tradingview

Notes: In my last Australian Dollar Weekly Price Outlook we noted that the, “The Australian Dollar rally faltered at confluence resistance with a weekly reversal off fresh yearly highs threatening a larger pullback.” Aussie fell more than 4% off the those highs before rebounding with price continuing to consolidate just below critical resistance at the 2020/2019 yearly opens at 7016/42 - a breach / close above this threshold is needed to keep the March rally viable.

Initial weekly support steady at the 2019 low close at 6733 with broader bullish invalidation set to the 2008 low-week close / 2019 swing low at 6660/70.A topside breakout / close above 7042 exposes subsequent resistance objectives at the 61.8% retracement of the 2018 decline at 7120 and the 2018 swing high / May 2017 low at 7295-7328.

Bottom line: The immediate focus is on a break of this multi-week consolidation formation in the Australian Dollar with the broader rally vulnerable while below 7042. From a trading standpoint, continue to be on the lookout for downside exhaustion ahead of 6660 IF price is indeed heading higher with a breach above 7120 ultimately needed to clear the way for a leg higher in price. Review my latest Australian Dollar Price Outlook for a closer look at the near-term AUD/USD technical trade levels.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

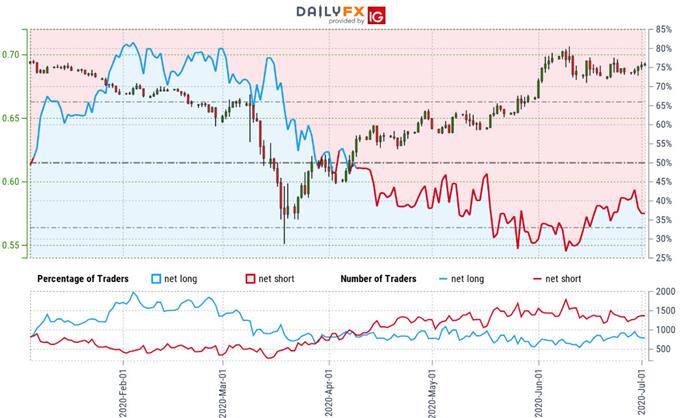

Australian Dollar Trader Sentiment – AUD/USD Price Chart

- A summary of IG Client Sentiment shows traders are net-short AUD/USD - the ratio stands at -1.6 (38.46% of traders are long) – bullish reading

- Long positions are 0.23% higher than yesterday and 2.35% lower from last week

- Short positions are3.06% lower than yesterday and 2.65% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests AUD/USD prices may continue to rise. Traders are less net-short than yesterday but more net-short from last week. The combination of current positioning and recent changes gives us a further mixed AUD/USD trading bias from a sentiment standpoint.

| Change in | Longs | Shorts | OI |

| Daily | -4% | -10% | -6% |

| Weekly | -1% | 25% | 3% |

---

Key Australia / US Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Previous Weekly Technical Charts

- British Pound (GBP/USD)

- Gold (XAU/USD)

- Japanese Yen (USD/JPY)

- Euro (EUR/USD)

- US Dollar (DXY)

- Canadian Dollar (USD/CAD)

- New Zealand Dollar (NZD/USD)

- Crude Oil (WTI)

--- Written by Michael Boutros, Technical Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex