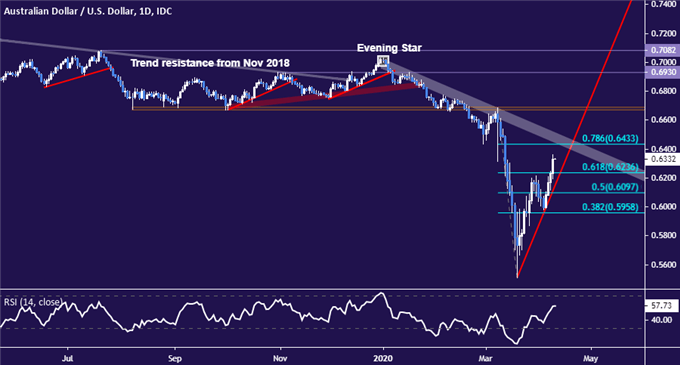

AUD/USD TECHNICAL OUTLOOK: BEARISH

- Australian Dollar racing upward to challenge 2020 trend resistance

- Breaking trend line support near 0.61 needed for bearish conviction

- Trader sentiment studies warn positioning may pivot to favor bulls

The Australian Dollar has mounted a spirited recovery against its US counterpart, pushing past resistance marked by the 61.8% Fibonacci retracement at 0.6236 to set its sights on a falling trend line defining the down move since the start of the year. This is bolstered by the 78.6% level at 0.6433.

Breaking above this juncture with confirmation secured on a daily closing basis may neutralize near-term selling pressure, setting the stage for a further recovery to challenge formerly long-standing support in the 0.6671-90 zone. Breaching counter-trend line support near the 0.61 is probably needed to make a compelling case for downtrend resumption.

AUD/USD daily chart created with TradingView

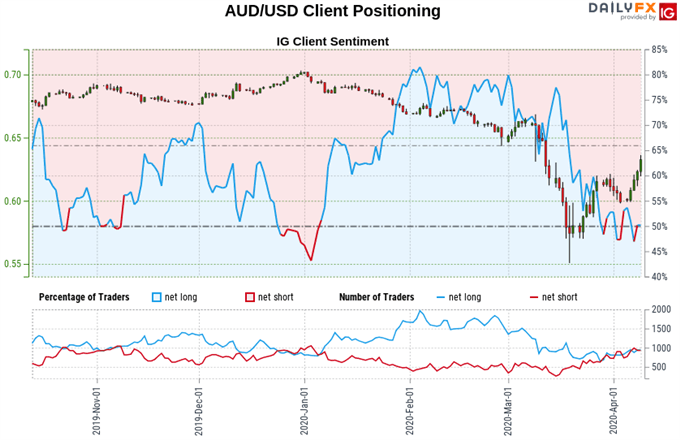

AUD/USD TRADER SENTIMENT

Retail sentiment data shows 52.17% of traders are net-short, with the short-to-long ratio at 1.09 to 1. IG Client Sentiment (IGCS) is typically used as a contrarian indicator, so traders being net-short suggests a broadly bearish AUD/USD trend bias.

However, the extent to which traders’ exposure is tilting net-short has diminished over the past week such that positioning is nearly balanced. That may be laying the groundwork for a sentiment flip that alters the balance in favor of the upside.

See the full IGCS sentiment report here.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free live webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter