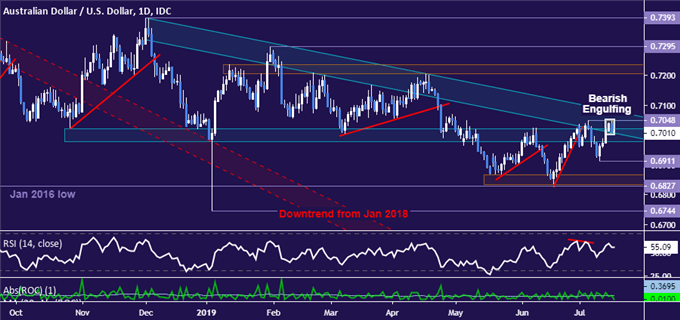

AUDUSD TECHNICAL OUTLOOK: BEARISH

- AUDUSD hints at double top with Bearish Engulfing candle pattern

- Confirming longer-term reversal calls for one-month trendlinebreak

- July’s swing top near 0.7050 continues to mark immediate resistance

Get help building confidence in your AUDUSD strategy with our free trading guide!

The Australian Dollar tried its luck on the upside once again. Last week’s attempt at bearish reversal was cut short above the 0.69 figure and followed by a retest of downward-sloping trend resistance capping gains since early December 2018. Sellers might yet prevail however as the appearance of a Bearish Engulfing candlestick pattern hints a Double Top reversal is in the works.

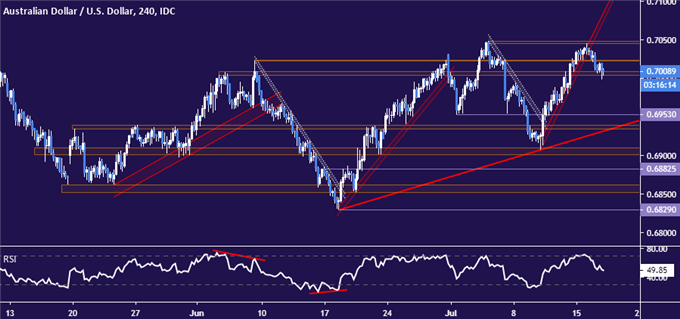

Zooming in to the four-hour chart appears to bolster the case for a downside scenario. Prices have demonstrably breached support defining the upswing from last week’s bottom, signaling that the move has been exhausted. Near-term support is holding back a deeper selloff thus far however, warning that the case for a reversal rather than mere consolidation is as-yet unconfirmed.

Breaking the broader upward trajectory established along swing lows over the past month seems like it would be a more convincing indicator of downward follow-through. That would amount to clearing the block of back-to-back support levels in the 0.6934-53 zone. Several minor inflection points aside, achieving such a break probably sets the stage to challenge the pivotal January 2016 bottom at 0.6827.

AUDUSD TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free live webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter