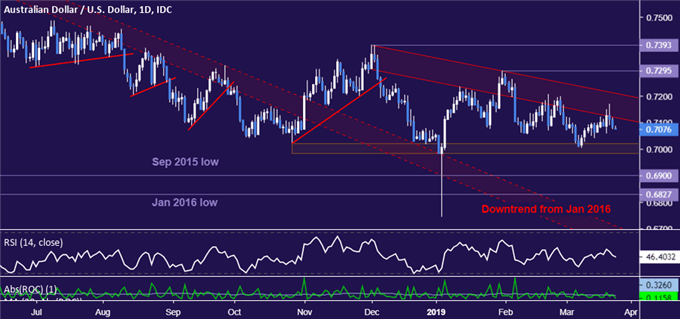

AUD/USD Technical Strategy: BEARISH

- Australian Dollar rejected at three-month resistance yet again

- Overall positioning still argues in favor of bearish resumption

- Break of near-term support line needed to build confirmation

Get help building confidence in your AUD/USD strategy with our free trading guide!

The Australian Dollar is pulling back after yet another test of resistance guiding the currency lower against its US counterpart since early December 2018. Overall positioning still hints at a Triangle formation, which carries bearish continuation implications in the context of drop from January 2016 top.

Confirming the setup would require a daily close below support in the 0.6982-0.7021 area. That would initially expose the 0.6900 figure as the next downside barrier. Alternatively, a break above the outer layer of trend line resistance – now at 0.7212 – targets the January 31 high at 0.7295 next.

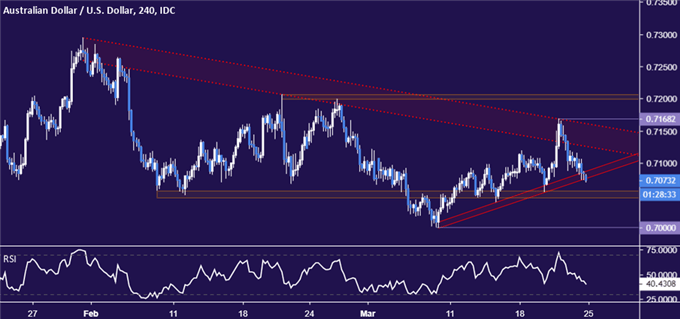

Turning to short-term positioning, the four-hour chart reveals that prices are testing counter-trend support underpinning the latest upswing from the March 19 bottom. The absence of a confirmed break seems to skew risk/reward parameters against taking up the short side for the moment.

Even if a break does materialize, a notable congestion area in the 0.7046-57 zone follows closely thereafter. On balance, this probably means that traders will wait for a piercing of the latter threshold before practically committing to a directional bias.

AUD/USD TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Trading Q&A webinar and have your questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter