AUD/USD Technical Strategy: NEUTRAL

- Aussie Dollar breaks past former swing high, sets sighs above 0.73

- Long-term positioning suggests overall trend bias remains bearish

- Absence of an actionable trade signal argues for a patient posture

Get help building confidence in your AUD/USD strategy with our free trading guide!

The Australian Dollar pushed past resistance marked by the January 11 swing high at 0.7235 in the wake of an FOMC policy announcement judged as dovish by financial markets. A choppy congestion area now looms ahead, with the next clearly identifiable resistance point marked by the December 3 high at 0.7393.

A beak above this barrier on a daily closing basis opens the door for a retest of former support in the 0.7452-61 area. Alternatively, a turn downward that takes price back below 0.7235 seems likely put the 0.7142-70 zone back into focus as the next downside barrier.

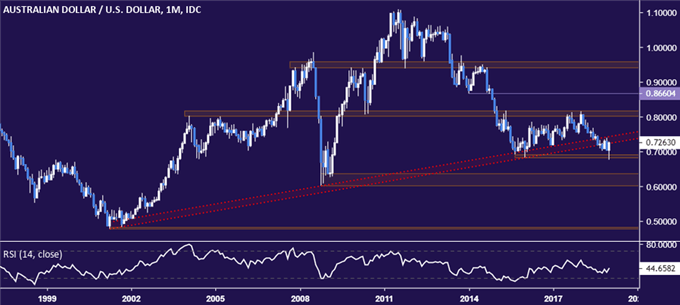

Turning to longer-term positioning, the monthly chart still seems to argue for a broadly bearish bias. The pair broke 17-year rising trend support in October and subsequent price action speaks to digestion rather than imminent recovery.

With that in mind, chasing the near-term rally upward seems uncomfortably counter-trend. On the other hand, the absence of a clear-cut bearish reversal signal means fading recent gains appears premature. That calls for patience, with a perch on the sidelines probably most appealing until an opportunity presents itself.

AUD/USD TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Trading Q&A webinar and have your questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter